The first time Bitcoin witnessed a US election was when it was only three years old. The cryptocurrency was about to celebrate its second anniversary as a tradable financial asset on now-defunct Mt. Gox exchange – even as half of the world assumed it was a scam, a Ponzi scheme, a terrorist financing/money laundering tool, and whatnot.

It was also the time of endless optimistic narratives. Some called Bitcoin a game-changer in the way global payments network operate: an utterly decentralized protocol that does a bank’s job for 99 percent less money.

Meanwhile, others had already started projecting it as the ultimate answer to the US dollar hegemony and the overratedness of gold as a hedging asset.

But even then, Bitcoin showed no correlation to the global stock market or events that impacted it. That also included a US presidential election, an event that is notorious for moving markets rigorously.

The one most significant takeaway from every Bitcoin performance around an election season is that it rose relentlessly after the event.

Bitcoin has matured into a global asset. Its value now takes cues from everything from coronavirus pandemic to the stock market crash and from a rising US dollar to the central banks’ unprecedented monetary policies.

Therefore, it is essential to revisit the last two presidential elections to know about its Bitcoin’s responsiveness to those events.

2012 and 2016: Big Rally, Small Correction, and Repeat

2012 was an iconic year for Bitcoin. The period saw nine months wherein the cryptocurrency closed at a significant profit. Meanwhile, there were just three months with negative results. One of them was a month before the 2012 US Presidental Election.

As Barack Obama battled Mitt Romeny for the oval office on November 6, Bitcoin experienced a modest downside move ahead of the event. In October 2012, the cryptocurrency shed about 9.98 percent of its spot rate. Before that, it had trended upward in the year by as much as 176.42 percent (data from BitStamp).

The rally eventually took the Bitcoin price to a new all-time high of $1,100 more than a year later. But the cryptocurrency crashed later to as low as $152, with researchers finding that Mt. Gox CEO Mark Kerpeles was behind the pump-and-dump.

As usual, the 2012 presidential election was a non-event for Bitcoin, which was then struggling with issues related to price manipulation.

A similar price action took place in 2016 as Bitcoin dropped nearly 12% five days before the US election between Donald Trump and Hilary Clinton on November 8. It then rebounded towards new higher highs.

Again, the factor that largely contributed to Bitcoin’s rise after the election was China’s capital control. It prompted the Chinese citizens to use Bitcoin as a tunnel to move money abroad, raising its demand against a limited and continuously decreasing supply.

The rally fumbled after China decided to ban Bitcoin trading in January 2017.

2020: Bitcoin Comes of Age

As stated, 2020 has been a game-changer for Bitcoin as far as it concerns global adoption.

The coronavirus pandemic and its subsequent impact on the international economy raised awareness about Bitcoin as a digital hedging asset. The cryptocurrency fell almost in sync with traditional markets and against the US dollar’s uptrend in March 2020. That was the first significant sign of its correlation with the mainstream assets.

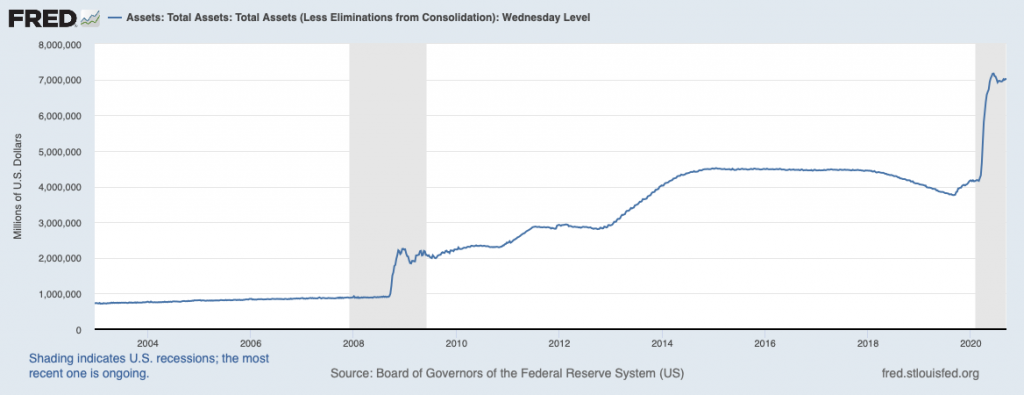

Later, Bitcoin recovered in tandem with Gold and US stocks as the Federal Reserve introduced new measures to tackle the coronavirus-induced lockdown. The US central bank committed to purchasing government and corporate debts endlessly. At the same time, it slashed its key lending rates to near-zero.

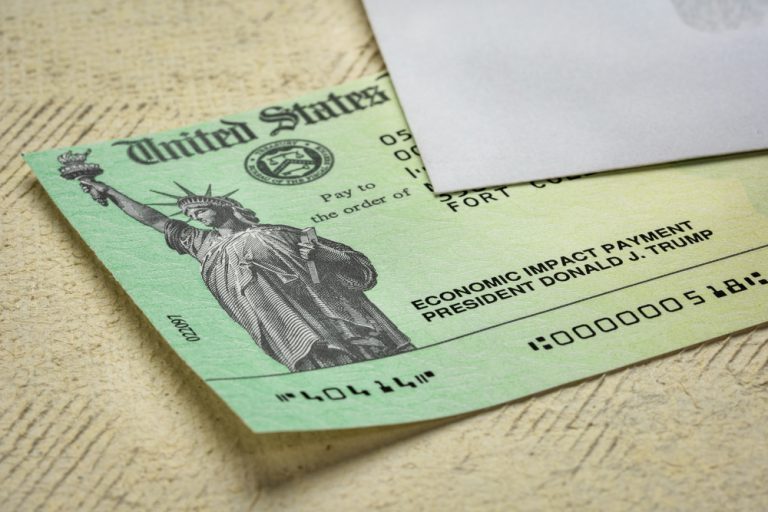

More support came from the Trump-led US government. They introduced a $2 trillion relief package to aid American households and businesses. In total, the fiscal deficit ballooned by almost $3 trillion in the earlier months, thereby reducing the purchasing power of the US dollar.

Between March and October 2020, the Bitcoin price rallied by almost 250 percent as more and more firms decided to use it as their hedging alternatives to the US dollar. Public-traded software firm MicroStrategy, for instance, converted $425 million of its cash reserves to Bitcoin. Payment firm Square also showed a $50 million BTC in their balance sheet.

The Second Stimulus

With coronavirus cases seeing a resurgence in the US, creating further distress for the American individuals and businesses, the US government has committed to releasing the second relief package.

Economists believe that the US Congress would finalize the aid after a clear win for Donald Trump or his contender Joe Biden. And once it’s out, the fiscal deficit will grow further, and the Fed would relentlessly continue its unlimited bond-purchasing and near-zero interest rate policies.

That means more downside pressure on the US dollar – and more upside moves in the Bitcoin market.

The cryptocurrency is a clear winner in the US presidential election 2020.

Since you’re here, feel free to check out the CoinStats cryptocurrency portfolio management app to track and manage your Bitcoin and altcoin investments.

The post A Look Into Bitcoin and Its Performance Around US Presidential Elections appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/a-look-into-bitcoin-and-its-performance-around-us-presidential-elections/?utm_source=rss&utm_medium=rss&utm_campaign=a-look-into-bitcoin-and-its-performance-around-us-presidential-elections

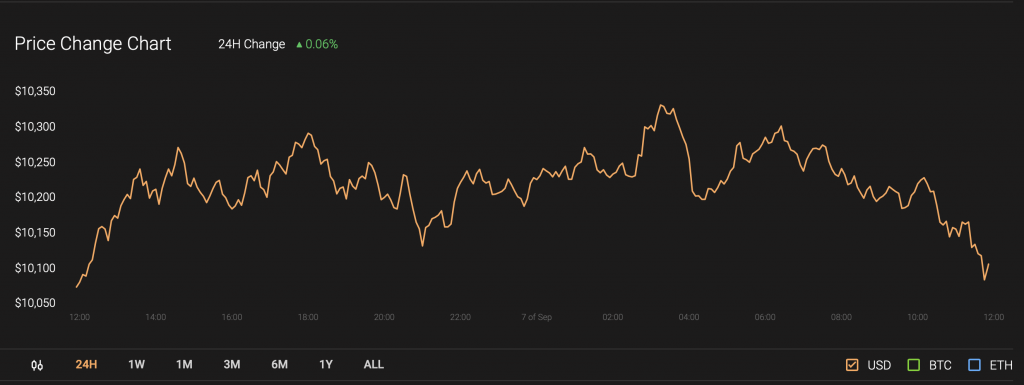

is signaling a short term bearish reversal continuing the Macro bearish reversal

is signaling a short term bearish reversal continuing the Macro bearish reversal now breaking out into new local highs

now breaking out into new local highs