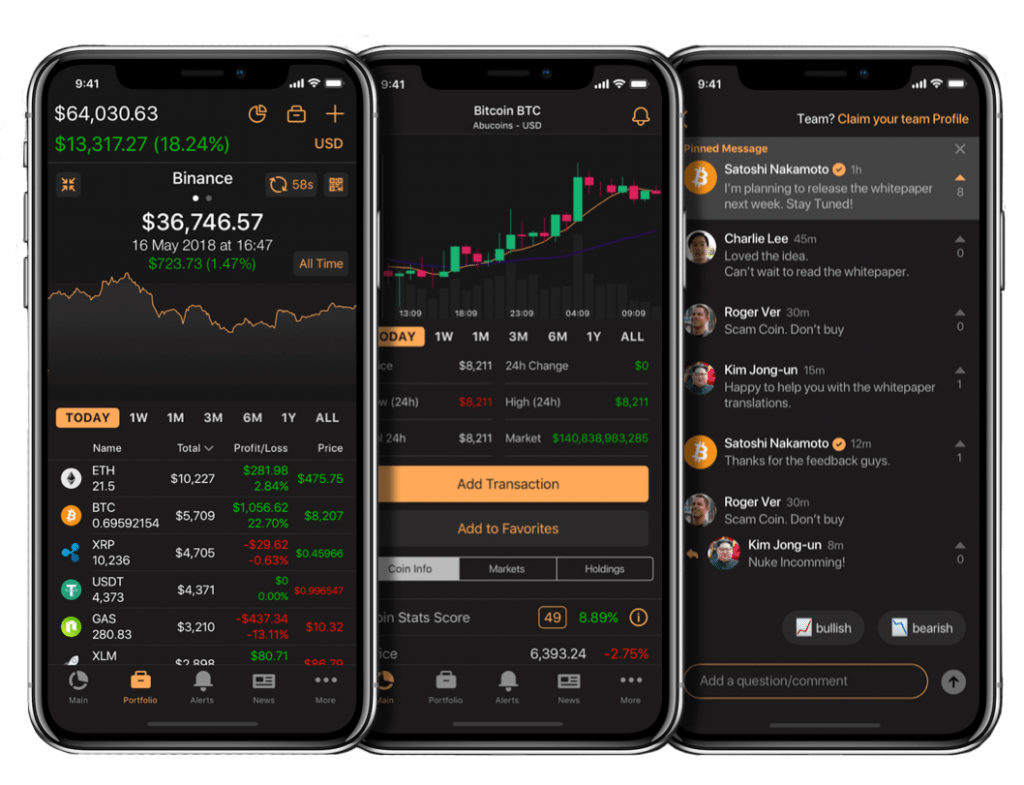

CoinStats is a top cryptocurrency portfolio tracker and research application, available on Desktop and Mobile (both iOS and Android).

Tuesday, December 24, 2019

Binance Fee Guide (for 2020)

Friday, December 13, 2019

IEO Frauds are Waiting to Happen

The week began on a very negative note for the cryptocurrency industry.

Matic, one of the first tokens issued via Binance Launchpad, witnessed one of the harshest crypto crashes. It plunged by up to 70 percent within a matter of two hours. The wild downswing led social media to scream price manipulation, with noted market analyst Alex Krüger comparing the event to a nightmare.

The native asset of Matic Network came into existence after Binance, one of the leading cryptocurrency exchange, approved to issue it on its newly launched Binance Chain. The integration further allowed the Matic team to list their token on Binance’s global trading platform. It exposed the cryptocurrency to hundreds of thousands of traders at once.

The process, commonly known as Initial Exchange Offering (or IEOs), offered the Matic Network a shortcut to fame. Signing up with a popular – and arguably trustworthy exchange gave them a concrete platform to sell Matic for hard capital. As usual, traders flocked at the opportunity to purchase the token at a discounted price.

They also invested in Matic because of their blind trust in Binance. The exchange took a reputational risk by promoting the token among its clients. Nevertheless, Matic skipped a vital regulatory check that could protect its investors from getting clipped by unforeseeable price crashes.

Allegations on Matic Team

People were quick to notice the involvement of the Matic team in the said price crash. One social media influencer highlighted transfers of over 1.4 billion Matic tokens to a Binance wallet. He alleged that the Matic founders were behind the large crypto shipments, adding that they are the ones that pushed the price down after flying them to all-time highs.

Your #matic masters dumped on you. https://t.co/cZE9FZgtVr

— I am Nomad (@IamNomad) December 10, 2019

Matic’s COO, Sandeep Nailwal, pleaded innocence. Binance co-founder and CEO Chanpeng Zhao also defended the founder team, adding that they would launch an investigation into the Matic pump-and-dump.

The Bigger Problem is IEOs Themselves

Matic ended up being yet another case study of extreme price manipulations in the cryptocurrency industry.

As one of the first IEOs, the token proposed to be a better version of an initial coin offering. But under no proper oversight for the Matic Network, as well as on Binance, the project could never guarantee that selling a token via an established exchange will change anything for investors.

Certainly, IEOs do not solve the problems that infected the ICOs. On the contrary, they give more control to largely unregulated cryptocurrency exchanges. Some of these trading platforms have earlier been hacked or have been found guilty of posting fake trading activities.

Michael Conn, a managing partner at Quail Creek Ventures in Los Angeles, had discussed with WSJ about how frauds are just waiting to happen in the IEO space. He said that “a lot of people got burned in ICO land,” and “a lot of people are going to get burned in IEOs land” as well.

The opinion editorial is penned by guest contributor Yashu Gola. He has written for major cryptocurrency outlets, including CCN, NewsBTC, and Bitcoinist, in his career span of five years as a journalist.

The post IEO Frauds are Waiting to Happen appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/ieo-frauds-are-waiting-to-happen/?utm_source=rss&utm_medium=rss&utm_campaign=ieo-frauds-are-waiting-to-happen

Thursday, December 12, 2019

How to Short Bitcoin in 2020 (Top 6 Ways)

There’s no denying that Bitcoin is one of the most volatile assets in the world. While volatility may turn more risk-averse investors away, it means there’s room to profit in both bullish and bearish markets if you know how to properly short the asset. Here’s how to short Bitcoin in 2020 and beyond.

First things first, what does it mean to “short” an asset?

Short selling is an investment method for making money when you expect an asset’s price to drop.

George Soros is famous for his short investment against the British pound. Now, Soros is sometimes referred to as the “Man Who Broke the Bank of England.”

In all reality, he did not break the bank but rather joined others who were heavily shorting the currency as they saw the British government hike up inflation rates into the teens during the days leading up to Black Wednesday.

Those who shorted the currency anticipated that the price of the currency would go down. As a result of their actions, the currency had to be pulled from the European Exchange Rate Mechanism.

Short = Borrowing Money from a Broker

Shorting Bitcoin means that you are simply borrowing money from a broker (usually a company but sometimes an individual) to purchase a stock. More specifically, when you are taking a short position, you are taking from the exchange’s internal supply with the expectation that you will return the same number of Bitcoin, stock, or what-have-you back to the exchange.

Here is another example:

Imagine you short sell 20 Bitcoin when the price of Bitcoin is $10,000. You sell them and this brings you $200,000 while leaving you 20 Bitcoin short. Bitcoin’s price drops from $10K to $8,000.00. Now, you see your chance to rebuy the Bitcoin at a lower price and gain $40,000 in total for your efforts. See, it’s not so hard to imagine an answer to the question “how to short bitcoin?”

Trading Bitcoin: Short vs. Long

A short position is obviously a direct distinction from longing a stock. When you long a stock, you are anticipating that the price of an asset will go up over time. This is what most people traditionally do when they invest.

For example, the traditional investor will develop an investment thesis, then go out and buy X shares of Peloton with the forecast that Peloton will go up to Y amount in Z time.

But how is it done in the cryptocurrency world?

Six Different Ways to Short Bitcoin

There is more than one way to short Bitcoin. Depending on your aptitude for risk, your level of patience, and the initial amount of money you’re willing to spend, you can find a short-position investment strategy that you mesh with.

From the more traditional bet on Nasdaq with the Bitcoin Investment Trust, to a binary trading option on an exchange like Kraken, there are many options to choose from (pun intended).

For the record, this is not financial advice. Do your own research!

Margin Trading

When you margin trade, you’re using borrowed money to open a larger position than you would have otherwise been able to do with your own funds.

For example, Kraken will directly lend money to a trader. The trader will open a position with that cash, then once the position is closed, the trader will repay the short back to Kraken.

Here are some of the best places to Margin Trade Bitcoin:

Prediction Markets

Prediction markets are a newer way for executing options on how to short Bitcoin, but the platforms are quickly growing in popularity. On a predictions market, you can demonstrate that you think Bitcoin will fall by a certain percentage or margin by a certain date. Another person in a predictions market can take you up on that bet. The bet is then locked-in on the platform.

Here’s a good resource to discover the top Bitcoin prediction markets.

Sell a Bitcoin Futures Contract

Like other assets, Bitcoin has a futures market. In futures trading, a buyer agrees to purchase a security with a contract. The contract specifies when and what price the security will be sold at. If you buy a futures contract for a higher price than what it is currently being traded at, that is usually associated with a bullish mindset. If you plan on selling a futures contract, it suggest a bearish mindset. Think about it, why would you want to sell a contract for less money than you expect it will be worth in the future (unless of course you needed the cash)?

Here are some of the best places to sell Bitcoin futures contracts:

Binary

The word ‘binary’ very simply means two things when you’re talking about how to short Bitcoin. You enter a trading position with a binary (two-sided) outcome- yes or no- that answers the question “Will an underlying asset be above a certain price at a certain time?” For example, you can predict the price of Bitcoin will fall below $7,300.00 by 12/15. Yes or no.

If the binary trade wins, you win the money, however, if the binary trade loses, your entire investment is lost. There are only two possibilities.

Directly Short-selling Bitcoin Assets

This is also not recommended for the faint of heart or those who already have trouble sleeping. A trader can short-sell currency directly from their own account by buying tokens at one price, then selling off tokens at the low-price they are comfortable with. This is the infamous “buy high, sell low” strategy that all desire to trade with. It can also work when answering the question ‘how to short Bitcoin.’ While this option is not as complex as some of the others, complexity isn’t everything. Less is more might apply here.

Short the Bitcoin Investment Trust

Traded on NASDAQ, the Bitcoin Investment Trust (NASDAQ: GBTC) tracks Bitcoin’s market price, then theoretically follows in price alongside it. The trust allows people to short and long Bitcoin without having to actually invest in the currency and while using more traditional financial trading systems.

In Closing

The price of the Bitcoin market is always changing, and when it’s going up, you know it could only go up for so long. When some investors see clear signs that the market is going south, then they often short the market or bet on the market’s downfall.

A short position is a much different strategy than longing the market. Then, even within short positions, there are at least six different ways you can bet on Bitcoin’s downfall. The strategies vary based on your aptitude for risk.

When it comes to tracking the performance of your portfolio, CoinStats has one of the highest-rated apps available on iOS and Android.

Good luck and happy trading!

The post How to Short Bitcoin in 2020 (Top 6 Ways) appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/how-to-short-bitcoin/?utm_source=rss&utm_medium=rss&utm_campaign=how-to-short-bitcoin

Monday, December 9, 2019

Is Binance Still Safe in 2020?

Is Binance still safe? After $40 million dollars in Bitcoin was stolen from the exchange earlier this year (in addition to several other blunders), people are wondering about the security of their digital assets held on what was once the world’s largest exchange by volume.

A Brief History

Binance’s rise to cryptocurrency exchange prominence was meteoric.

- The world’s largest cryptocurrency exchange by trading volume;

- CEO makes the cover of Forbes at height of crypto bubble;

- The team becomes billionaires;

- The mighty fall.

It launched in 2017, and by the end of 2018, Binance was the world’s largest cryptocurrency exchange doing more than $500-million-dollars of business… a day. The exchange marketed itself favorably with low trading fees and offered a proprietary coin called BNB. The coin itself had an ROI of 9,000% in the last 2.5 years. Additionally, if you used the coin within Binance’s ecosystem, it allowed users to experience some of the lowest fees in the industry.

Binance’s CEO, Changpeng Zhao, aka CZ also rose to fame. In February 2018 CZ made the cover of Forbes Magazine with the text: “Crypto Overload CZ– Zero to Billionaire in 6 Months.” Before his rise on Binance’s coattails, CZ made his career at the Tokyo Stock Exchange as well as Bloomberg Tradebook, positions he held as a developer of future trading softwares.

So Binance rose so quickly to the top, with its features, and leadership, and numbers… and it’s impenetrable security.

Oh, how the mighty fall.

It was only a matter of time until hackers hit Binance hard. Roughly $40 million dollars in cryptocurrencies were stolen, which was nearly 2% of the coins held by the exchange at the time.

Trust Fades Amidst Despite Some Transparency

The image that Binance once held as a beacon of safety faded in 2019. While the company has been applauded for its ability to communicate in the past, at least by some, even that image is becoming opaque in response to issues discussed below.

That’s not how it always was. Binance’s CEO, Changpeng Zhao, immediately fessed up to the company’s security failure and promised to refund all of the 7000 or so missing Bitcoins. Biance was working toward improving security protocols and it’s smart enough to keep the exact specifics of these implementations secret.

However, the exchange will forever be in the crosshairs of cybercriminals looking for both massive bucks and bragging rights. No matter the security measures Binance implements, they won’t be able to get around sophisticated phishing techniques in which users mistakenly give hackers their information.

Other Risk Factors

One of the major risks of using Binance as your exchange today is the improved Two-Factor Authentication (2FA) locking users out of their own accounts. That’s the last thing you want when you go to sell your cryptos at what could be the high of the month. While Binance made slight improvements, it seems like whatever security improvements it has made were overzealous because the end result is that the 2FA still rejects user login attempts.

This was around the same time complaints started to surface about the slowed and seemingly non-existent response to the 2FA issues. Bad customer service can cost you thousands of dollars in the lightning-fast world of crypto.

The Binance Office Issue

Another point to consider when evaluating how safe Binance is is the stability of Binance’s offices. They have been running from regulators, switching locations from Shanghai to Tokyo to Taipei to Malta, all in the space of a year and a half. Rumors swirled on the offices closing for good, and although closure rumors appear to be unsubstantiated, all of this affected the crypto market.

The amplifying uncertainty, even if it’s unsubstantiated at times, on top of the hopping around for headquarters more than once in the short two-year history leaves the world wondering, “Is Binance safe?”.

It has gone from a #1 ranked exchange on many crypto news networks to not even scraping the bottom of the top 10.

It’s not all Binance’s fault and, as an exchange, they have done a tremendous amount to make trading digital assets cheaper, more profitable, and more accessible. They are not scammers either, they were a reputable and trusted company that now has a damaged reputation, unlike, for instance, OneCoin – which was a full-on Ponzi Scheme.

Binance is Not Alone

Binance is not alone in its challenges. It will be a glorious day for us all when a top crypto exchange deflects all attacks from hackers forever. Every major credit card company faces fraud and cybercrime on a daily basis, digital stock exchanges are susceptible to attack – Robinhood even admitted to storing user login info in unencrypted areas where hackers could easily access it- and we all hear about know about how titanic companies like Sony and Visa are compromised regularly.

If you truly want your digital assets to be secure, you CANNOT store them in a hot wallet on an exchange.

Anyone asking themselves “is Binance still safe” who keeps a large portion of their portfolio in another exchange may fall prey to a phishing scheme or a virus.

For example, CryptoShuffler steals key information about addresses from cached copy paste clipboards. Investing in a hardware wallet like Ledger Nano S, which costs less than a night on the town, will secure your cryptos better than any exchange. Be sure to keep copies of your seed keys and other valuable information for emergencies. Of course, keeping your wallet offline adds unwanted time to facilitating transactions. There is always a trade-off.

In Closing

The fact that people around the globe are even asking is Binance still safe means they have lost consumer trust, and despite this industry being about trustlessness, trust is still paramount. If you are going to use a hot wallet on a crypto exchange, be sure you only keep an amount you can live with losing to hackers. Choose an exchange you can stand by.

The post Is Binance Still Safe in 2020? appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/is-binance-safe/?utm_source=rss&utm_medium=rss&utm_campaign=is-binance-safe

Wednesday, November 27, 2019

I Am an anti-FUD Bitcoin Op-Ed Piece

Bitcoin is back in the news again. This time, due to all the bad reasons.

The benchmark cryptocurrency earlier this month slipped by up to 38 percent from its local peak of $10,540, according to data provided by CoinStats’ cryptocurrency portfolio management app. Meanwhile, it remained stuck in a much larger downtrend after establishing $14,000 as its year-to-date top, crashing by as much as 52.94 percent as of November 25.

The massive slip is – technically – a correction. Before it started dwindling downwards, bitcoin had surged by more than 200 percent from its last-established bottom near the $3,100 level. The asset’s Relative Strength Indicator on larger timeframes shows that it became severely overbought at many junctures.

Let’s admit: No trader would willingly put additional capital into bitcoin after the cryptocurrency performs a volatile bull run. Their strategy is to either wait for bigger whales to keep pumping the asset or simply exit the market while making attractive returns. They chose the latter, sending bitcoin down.

Nevertheless, several theories attempt to outsmart the technical explanations. Some believe that it is China’s government strictness that crashed bitcoin by more than 40 percent. At the same time, others think miners were massively selling off their BTC stash, thereby increasing the downside momentum in the market.

Fundamentals are Guesses

Although, before making any assumptions, one needs to realize that bitcoin’s catalysts are non-static. Earlier this year, the cryptocurrency might have established earth-shattering gains backed by the escalations in the US-China trade war, yuan devaluation, as well as Facebook’s foray into the world of digital currencies via Libra, but the same factors are not working anymore. Bitcoin is going down even though investors should be focusing on it as the next-best safe-haven asset against the ongoing macroeconomic turmoil, just like Gold or US Treasury bonds.

So even if the Chinese government or a small proportion of a vast mining community could hurt bitcoin, they cannot possibly foresee a systematic selling of the cryptocurrency. What the market appears to be witnessing is small traders getting scared by the FUD and, thus, selling their stash. It’s a trade cycle, at best – the one which experienced its highs and is now going through a rough wave of lows.

Again, no miner capitulation. Selling, yes, capitulation, no.

— Alex Krüger (@krugermacro) November 21, 2019

If going to panic, find the right reasons to panic about.https://t.co/5i9Io3aFnl

Besides, it has been clearly established that more than 90 percent of the bitcoin community comprises of speculators. They are those who do not put the cryptocurrency to any use but HODLING. These bulls expect central bankers to devaluate their national currencies, cause inflation, and, in turn, push a geeky population towards bitcoin, a supposedly deflationary asset.

Unfortunately, none of such events have helped bitcoin regain its upside momentum as of late. The US Federal Reserve announced the third rate cut. Nothing. The European Central Bank will begin its expansionary quantitative easing plan. But such a risk cluster has not brought any new capital into the bitcoin market, nonetheless.

Then there are bitcoin bulls betting big on governments failing. Leigh Cuen of Coindesk lately offered evidence that people were unable to make use of bitcoin during the period unrests. She cited examples from riot-struck Lebanon, Iran, and Hong Kong, wherein protestors could not use bitcoin because of a lack of internet access.

IN DEPTH: Protesters across the globe are testing out bitcoin and other decentralized technologies – then promptly discovering their limitations. https://t.co/Tk2m3A1faJ @La__Cuen reports

— CoinDesk (@coindesk) November 21, 2019

That One Logical Catalyst

Bitcoin is a great asset, nevertheless. Perhaps it is one of the only key innovations that is born to become a financial asset. If trusted by a wider base, it could easily steal away a chunk of Gold’s market, another asset that investors prefer to speculate on rather than putting it to actual, industrial use.

Institutional adoption, as the term goes, is happening at a gradual pace. Established firms are launching bitcoin-enabled trading products. Regulators and governments are willing to write new fintech laws to make space for decentralized financial assets. These developments create the level of trust big monies require before putting their capital into any market. Until that happens, let’s expect less HODLING and more price volatility.

What bitcoin is doing today is reacting to the sentiments of emotional traders. What it could do tomorrow is sit ideal in a regulated custodian’s vault, serving as an ideal asset to manage portfolios of thousands of hedge funds, family offices, pension funds, and even us small traders.

The post I Am an anti-FUD Bitcoin Op-Ed Piece appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/i-am-an-anti-fud-bitcoin-op-ed-piece/?utm_source=rss&utm_medium=rss&utm_campaign=i-am-an-anti-fud-bitcoin-op-ed-piece

Top 6 Alternatives to Coinranking

It’s important to use the right crypto portfolio tracker to manage your investments. If you don’t pick the best technology to handle your digital assets you could miss out on tools and insights you need to succeed.

Coinranking is one of the top sites on the web for tracking the prices of your favorite coins, but it has much more limited functionality than many alternative offerings. Coinranking doesn’t have a native app nor does it interact with other IoT devices like a smartwatch, its services list more limited information than many of the offerings highlighted below, and it doesn’t offer price comparisons across internationally-used currencies.

As you explore alternatives you’ll find not all crypto portfolio trackers are made equal. It’s easy to end up using a service that does not provide accurate information or has a user interface that makes it difficult to navigate the platform.

Points to Consider About Portfolio Trackers Before Purchasing

You want a product you can trust: one that will track all over your holdings in one easy to use place. Your tracker should give you valuable insights about what is happening in the market. It should provide you with the most current industry news to keep you knowledgeable. A crypto portfolio tracker should alert you across platforms when there is a major shift regarding the price point on your investments.

In short, a crypto portfolio tracker should help you make money.

With hundreds of business offerings to choose from for tracking your digital assets, it’s hard to know what to use. We’ve done the legwork for you to endure you end up using the service that best suits your needs.

Here are the top six alternatives to Coinranking:

CoinStats

CoinStats is an industry leader in crypto portfolio tracking, with offerings that cater to everyone from amateur HODLers to professional investors. The app tracks over 300 cryptocurrencies with information across 100 exchanges and aggregates crypto news from over 40 online news networks.

You can either select coins manually to build a custom portfolio to track your selected investments and the movements of chosen coins, or you can simply sync your wallets and exchanges.

CoinStats sets itself out apart from the competition with its highly accurate CoinStats Insights feature. This particular product features analysis based on market trends and user data.

The Buy/Sells Today Insight correctly predicted a Bitcoin price bump over the summer and is regarded by some as a useful tool for acting on trends in both day trading and long term holding.

These insights are only available on the premium version of the app, which also sends order fill notifications. The premium subscription is very reasonably priced.

CoinStats also has much more information readily available than Cointracker: showing you 24-hour market volumes along with market change, giving the price of coins relative to bitcoin, and allowing users to see the price of coins across a variety of currencies.

For these reasons (among even more great features), CoinStats was selected as the official Crypto Tracking app of Chainpoint.

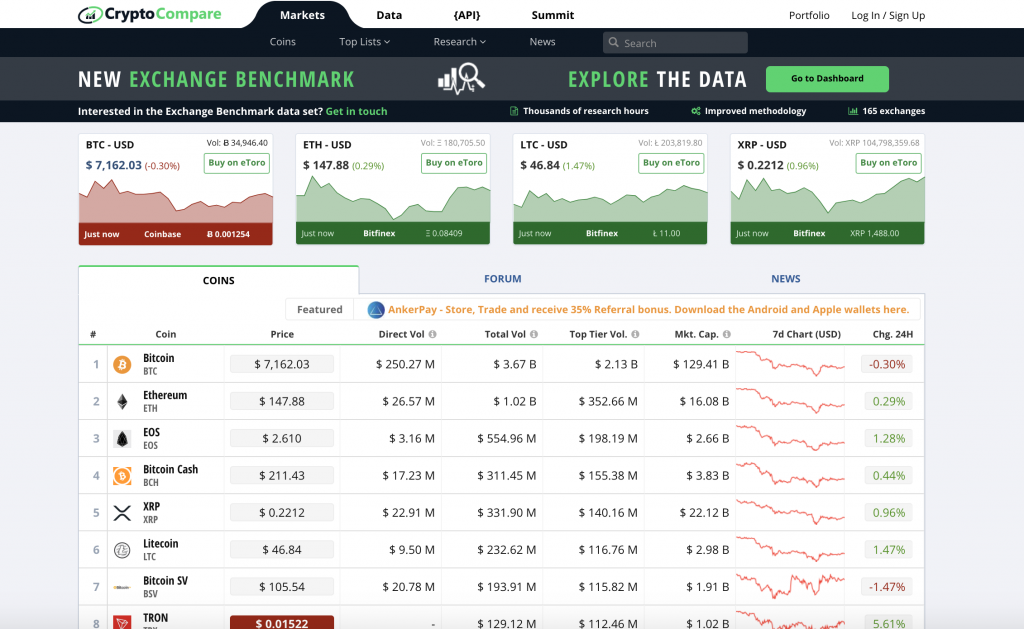

CryptoCompare

CryptoCompare is a British cryptocurrency tracker that offers a variety of more specialized analytics, such as side-by-side visualizations of the most traded coins, and up-to-date information about top mining companies and ICOs.

CryptoCompare’s depth of information is one of its major bragging points. The company goes as far as offering in-person, educational events in London, an experiential marketing opportunity that other companies could benefit from.

CryptoCompare offers information in a limited number of supported foreign currencies. There are many people, especially developers, who may love CryptoCompare’s offerings such as the APIs and the ability to design custom widgets.

Gem

Gem features a sleek unicorn interface, an extremely fun UI that’s styled off of the colors of a unicorn. The main strength of Gem is it’s UI, although it does not track as many exchanges or coins as some other apps on this list, it does allow users a highly intuitive (and entirely free) experience.

Gem allows you to view your uploaded assets across currencies, yet there is no obvious way of syncing your portfolio. Unlike the other offerings on this list, Gem does not have a web version of their app. Depending on your specific needs, this could be a feature or a bug.

Download the Gem app for iOS and Android.

BlockFolio

Blockfolio is a mobile-only offering, which may deter users who like to track their cryptos online. Regardless, their app is top-notch.

This crypto portfolio tracker is geared more towards serious professionals and it tracks more coins than any other platform on our list— 8000 coins across 300 exchanges.

Blockfolio integrates into Slack and boasts Blockfolio Signal, a messaging service that allows token teams to directly engage with the community. This is a lot of functionality and may provide more than the average user needs, but if you are looking for a mobile-only tracker, this one is one of the best out there.

KryptoGraphe

KryptoGraphe is another mobile-only Crypto portfolio tracker that offers a robust selection of features across three payment plans: free, premium, and gold.

KrpytoGraphe offers not only analytics across currencies, but the app itself is also available in 13 languages, making it accessible to international users.

They show not only how your portfolio is performing, but how it is doing compared to other traders in the market. The highest tiers offer performance/loss and tax reports as well. This gold plan also offers automated coin alerts, which are available at a much cheaper cost in some of the other paid plans highlighted in this article.

Cointracking

Cointracking offers some of the best functionality on this list, however, it is also the most expensive service. The highest tiered plan is priced at .035 BTC (over 225 dollars annually at current market prices).

Their free plan allows you to track 200 transactions, while their highest tier plan tracks unlimited transactions.

There is a clear disconnect between the services offered at the lowest plans and the paid services: which include API access to your portfolio and tax services. For professionals, they do provide a lot of functionality, only at a very high price point.

Though there is an app, all the trades need to be entered through the website, which can lead to frustration.

In Conclusion

There are hundreds of options for Crypto Portfolio Tracking and the service you end up using will be dictated by your particular needs and budget.

Coinranking is a popular option but does not have as robust features as some of the competition.

The post Top 6 Alternatives to Coinranking appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/coinranking-alternatives/?utm_source=rss&utm_medium=rss&utm_campaign=coinranking-alternatives

Tuesday, November 19, 2019

That Big Bullish Bitcoin News is Out

CoinStats’ data feed shows no improvement in the bitcoin price this week. The cryptocurrency has dipped by as much as 24 percent from its local swing high of $10,540. And more likely, it is going to continue its fall as investors focus remains wary ahead of the Federal Reserve’s decision on the next rate cut.

But as bitcoin slips on technical grounds, its fundamentals, on the other hand, are getting better. The latest moral push comes from a Boston-based financial giant, which has about $2.8 trillion worth of assets under management, and which is interested in exploring opportunities for bitcoin on Wall Street.

So it appears, Fidelity Investments has begun with a bang. The company’s new wing, named Fidelity Digital Assets, has won a bitcoin trading and custodianship license from the world’s strictest cryptocurrency regulator, the New York Department of Financial Services (DFS).

Fidelity announced on Tuesday that it will start offering institutional investors an option to transfer, trade, buy, and sell bitcoin via its regulated digital assets platform. The announcement read:

“We’re setting the standard for institutional-level services for digital asset investors. We’re bringing professional financial standards to digital assets. From the security and risk management of our custody offering to our world-class client service, we’ve created the blueprint for institutional-grade standards for the digital assets industry.”

Paving Way for Institutional Adoption

Big investors so far have ignored bitcoin. While hedge funds, family offices, and even individual tycoons see the cryptocurrency as a great risk-off alternative, they have also expressed concerns about the market’s inability to protect it from getting hacked or manipulated. The Bitcoin spot market remains highly unregulated, which makes it a very risky investment option for institutions.

Fidelity Digital Assets is one of the first companies to have solved the so-called trust issues. The subsidiary proved its operational excellence after a big four accounting firm reviewed it positively for handling clients’ bitcoin funds. That washed away one of the biggest worries institutions had about the cryptocurrency: the wallet hacks. Fidelity stated:

“We have designed and instituted a comprehensive security program and risk management framework to maximize the protection of our clients’ assets. We already have a very strong risk management culture here and have applied that expertise to protect against the unique considerations needed for these assets.”

That is also one of the main reasons why DFS approved Fidelity. The company not only showed a highly reputed background in finance, but it also displayed preparedness when it comes to integrating bitcoin into the world of mainstream finance.

“This approval is further evidence that innovation and consumer protection can coexist in New York’s evolving and expanding financial services industry,”

said Linda Lacewell, the DFS’s superintendent of financial services.

Bitcoin on Wall Street

The regulatory approval for Fidelity Digital Assets comes at a time when investors on Wall Street are helplessly treating risk-on equity assets as their safe-haven. The US stock market is hitting new highs even though there is plenty to worry about. Analysts call it the ‘There is No Alternative’ mode – a backronym for TINA – wherein investors run out of options while looking for hedging assets.

The Federal Reserve’s decision to cut back rates made returns on government bonds less attractive. Meanwhile, S&P 500, Nasdaq, and Dow Jones rose despite a never-ending trade war between the US and China, a dwindling global economy, and geopolitical tensions that are gradually materializing into full-blown conflicts.

“You are not seeing the party hats going on the floor of the New York Stock Exchange,” said JC O’Hara, the chief market technician at MKM Partners. “The average investor has a healthy degree of skepticism. They are very aware of the signs that an economic slowdown is taking place. But in a TINA market, where are they going to put their money?”

Bitcoin maximalists have constantly projected it as “THE ALTERNATIVE.” The asset remains non-correlated to mainstream financial instruments, does not give a damn to the central bank policies, and is growing nevertheless helped by growing trade speculation.

Fidelity’s ability to bring Bitcoin on Wall Street is certainly going to attract eyeballs of some institutions. The ongoing macroeconomic crisis could behave as the sole reason why investors start allocating some part of their portfolio to bitcoin. Such a move could benefit the cryptocurrency hugely.

Fidelity just launched their crypto trading and custody services for all qualified investors.

— Rhythm (@Rhythmtrader) October 19, 2019

If Bitcoin grew to $150B on retail interest, imagine what $2.8 trillion in assets and millions of investors will bring to the table.

Like Fidelity's CEO said, “It's not going away"

The post That Big Bullish Bitcoin News is Out appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/that-big-bullish-bitcoin-news-is-out/?utm_source=rss&utm_medium=rss&utm_campaign=that-big-bullish-bitcoin-news-is-out

The 5 Best Crypto Portfolio Trackers in 2020

The age of digital finance dictates a market pace that can change the value of your crypto assets at any time of day. That means you deserve a crypto portfolio tracker that you can trust to accurately illustrate the true value of your assets in real-time. While some portfolio trackers fall short in data accuracy or poorly executed UI, others integrate features that illustrate a more careful ear to the market.

This guide is meant to serve as a comparison between different cryptocurrency portfolio trackers, and to help you identify what is the best crypto portfolio tracker for you.

The guide includes:

- A product-by-product glimpse at the tech specs that make some of the leading crypto portfolio companies unique;

- The latest updates from the best cryptocurrency portfolio trackers;

- What makes each of the portfolio trackers unique;

- Interactive links and images so that you can explore in more detail on your own.

Points to consider before starting:

1) Why do you want a crypto portfolio tracker: Will you be exclusively using basic features (e.g., checking your crypto portfolio or setting notifications for certain price updates?), or do you plan on using more complex analysis and premium services?

2) Web or app: Do you want a portfolio mobile app, or just web access?

3) How many coins: Are you interested in tracking data about early-stage companies and ICOs, or just the top coins like BTC and ETH.

Your answer to the aforementioned questions will dictate which portfolio tracker is best for your unique trading needs. Portfolio tracking is not a one-size-fits-all type of crypto experience, and your logic for choosing one portfolio tracker over another would be different than someone else’s.

Here’s how the top portfolio trackers differ:

CoinStats

Considered to have some of the highest functionality in the industry, Coinstats offers a mobile application and smart watch-enabled tracker that is highly rated across Mac OS, iOS, Apple TV, and Android. Alongside a strong UI, the CoinStats ecosystem supports over 3,000 coins and receives info from 100 exchanges in real-time. Additionally, the portfolio tracker aggregates news from over 40 sources.

CoinStats is also uniquely positioned to cater to serious investors through the CoinStats Direct feature. Using this exclusive feature, teams and investors alike can enjoy the benefits of a highly secure, verified platform for news and announcements.

The free version of the app is super feature-rich but, for even more great features like unlimited syncing with exchanges and wallets, order fill notifications, and CoinStats Insights.

Interestingly, the CoinStats Insights feature predicted this summer’s Bitcoin price pump.

CoinStats Pro costs $4.99 per month or $39.99 if paid yearly.

Find out more information about CoinStats here.

KrytoGraphe

Aside from offering the standard portfolio tracker options like profit and % of growth, Kryptographe also offers some competitive analysis tools that similar to the analytic niche Peloton is currently capturing in fitness. Kryptographe’s percentile score feature shows how your portfolio is performing relative to other investors.

Additionally, Kryptographe has three pricing options starting with a basic, free plan, a mid-tier plan at $49.99 per year, and a gold plan at $69.99 per year.

This portfolio-tracker focuses on delivering a product that can be globally accepted, which is why they have their product and platform available in thirteen languages.

More information can be found here.

CryptoCompare

Delivering access to 5,300 coins and 240,000 currency pairs, CryptoCompare is a market-leading portfolio tracker. The crypto tracker also offers educational content and research on topics such as coins, gambling, wallets, and mining, in addition to an educational event they host in London. The green and black UI feels a bit antiquated, almost as if it were the color themes of a computer café from the early 2000s.

There is a dedicated resource section called “Guide” which is just a collection of sponsored pieces.

However, for the developer community, CryptoCompare offers widgets and APIs. Users are granted an opportunity to design a widget by selecting advanced token metrics for some of the world’s leading currencies, such as Bitcoin and the US Dollar.

More information about CryptoCompare can be found here.

CoinTracking

With a platform that caters more toward experience cryptocurrency traders that are looking beyond the basics, CoinTracking offers a solid option. Data is imported directly from over 50 exchanges and boasts a user base of 400,000 people.

Signups are only allowed on the company’s website but there is an app that can be accessed once the signup is complete. Additionally, all of the trades need to be entered through the website, hence, you cannot use the mobile app for that, an experience that’s left for wanting.

There is a serious distinction between free and paid versions of the app, with the former offering very limited features. Perfect for the beginner or someone that does not care about complex features.

More information can be found here.

Gem

With real-time information syncing from more than 20 crypto exchanges, you can keep your balances updated on Gem. This portfolio tracker is the only one in the list that is entirely free, and tracks over 2,000 digital assets 20 different crypto exchanges. The branding is distinct, drawing on the theme of unicorns which adds to how engaging the UI is.

While there is a dedicated section to educational articles and a podcast on Gem’s website, there has not been any content from February to November of 2019.

More information about GEM can be found here.

In Conclusion

It should be pretty clear to see some emerging themes from some of the top crypto portfolio trackers. The most apparent of which being that in order to be successful, a portfolio tracker must possess professional relationships with many exchanges.

The relationship between the tracker and the exchange is symbiotic, and one in which the entire industry relies on for data accuracy. Other similarities between portfolio trackers include the need to deliver a strong UI, API availability, and, most often than not, complex trading and analytic tools.

Additionally, there is a unique distinction and identity of each portfolio tracker that the companies have carved within themselves to stand out amongst competitors. Whether that be distinct branding, investor tool/ chart complexity, or investor comparison analytics.

Portfolio trackers are a necessary piece for every crypto investor. Otherwise, you’re the type of person who can go years without knowing the value of an asset, or you’re going to crash CoinMarketCap because of how many times you refresh it.

The post The 5 Best Crypto Portfolio Trackers in 2020 appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/best-crypto-portfolio-trackers/?utm_source=rss&utm_medium=rss&utm_campaign=best-crypto-portfolio-trackers

Monday, November 18, 2019

Bitcoin Now Powers an Anti-Hong Kong Police App

Just recently, Apple removed HKmap.live, an application that showed a real-time crowdsourced map of protests in Hong Kong, alleging that it facilitated attacks on individual officers and vandalization of public areas where the police were not available.

Kuma, the pseudonymous developer of HKmap.live, said in an interview with Laura Shin that Apple had no evidence to justify their app’s removal. He accused the firm’s CEO Tim Cook of being a puppet to the Chinese authorities, stating that Apple earns about $44 billion every year from China itself, which prompted them to act partially towards HKmap.live.

“Funding for anti-government movements in an oppressive regime is dangerous. After all, legality is defined by governments. Our encounter with Apple shows that the HK government can declare us violating laws without citing any evidence and specific law that we broke,”

said Kuma.

The Bitcoin Backup

The removal from the App Store led Kuma to look for alternatives to fund his app. Eventually, the developer decided to raise money using non-sovereign assets such as Bitcoin, Ethereum, Bitcoin Cash, Monero, and others.

Kuma told Shin that cryptocurrencies like Bitcoin offer HKmap.live users and donators much-needed pseudo-anonymity. He claimed that he had so far raised thousands of dollars via cryptocurrencies, which helped him pay for operational and hosting, as well as legal costs. The funds are also acting as reserves for creating more apps for Hong Kong protestors.

“Funding is an area we can hardly decentralize,” added Kuma, “except receiving hard cash donations. HKmap probably is the first to push cryptocurrency donations in Hong Kong.”

Accessing Crypto Still a Problem

Kuma also criticized the current infrastructure of the cryptocurrency industry, wherein users cannot purchase the assets without revealing their identity. Excerpts:

“Personal information is the last thing Hong Kong protestors want to share with a lesser-know third party when the government is hitting hard. I think it can be fixed with increased adoption.”

The post Bitcoin Now Powers an Anti-Hong Kong Police App appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/bitcoin-now-powers-an-anti-hong-kong-police-app/?utm_source=rss&utm_medium=rss&utm_campaign=bitcoin-now-powers-an-anti-hong-kong-police-app

Monday, November 11, 2019

Is China about to Lift the Bitcoin Trading Ban?

The animosity which was brewing between a country and an emerging financial technology is appearing to come to an end.

China is taking its first few steps towards recognizing Bitcoin, a non-sovereign asset, as a groundbreaking innovation. Asia’s richest economy slapped a banking ban on the emerging Bitcoin industry in late 2017, leading to the migration of thousands of young companies. The government feared that its people would use Bitcoin to circumvent capital control laws, launder money, run illegal crowdfunding programs, and facilitating every kind of illicit activity online, ranging from child pornography to drug trafficking.

One cannot blame the government for being precautionary. Bitcoin was not exactly acting as a groundbreaking technology back in its early days. Its seamless use in now-defunct darknet Silk Road, followed by a multi-million dollar hacking incident on Japanese exchange Mt Gox, left central bankers worried. China, in particular, saw Bitcoin as a threat to its people. In December 2013, it banned financial institutions from dealing with bitcoin transactions, a move that later shaped into a full-fledge ban of trading cryptocurrencies.

As China went ahead with its hate-relationship with bitcoin, the country meanwhile never shied away from borrowing the cryptocurrency’s underlying technology – the blockchain – to create a digital version of its official currency Yuan.

At the same time, China also remained host to more than 80 percent of mining companies – data centers that offer the computing power to run the bitcoin’s decentralized payment network. Nevertheless, the country’s State Administration of Foreign Exchange led by Pan Gongsheng announced in early 2018 that it would begin a crackdown on the regional bitcoin mining industry.

All in Hindsight

A string of new updates coming from China is now hinting that the country is taking a softer approach to Bitcoin. On October 25, President Xi Jinping endorsed the blockchain technology in a public address, stating that his regime would allocate about $2 billion in its research and development. The news sent the bitcoin price up by as much as 41.85 percent, showing how traders interpreted good news from China as a major bullish signal.

China did not just stop with Jinping’s blockchain endorsement. The coming weeks would see the country taking the necessary steps to strengthen its regional cryptocurrency industry. For instance, China’s National Development and Reform Commission left bitcoin mining out of its list of restricted activities, according to an announcement made on November 7.

The latest event that supports China’s softening stance on bitcoin is news coverage of a state-run newspaper. Xinhua on November 11 published an insightful editorial about Bitcoin, the first of its kind since the Chinese government imposed a blanket ban on cryptocurrency trading.

The article worked as a bitcoin-explainer but – yet – it largely focused on the cryptocurrency’s negative aspects, including price volatility and rumored centralization of the bitcoin mining. Nevertheless, Xinhua ended up putting bitcoin on the front page of a newspaper that is read by millions of people across China.

China is literally running front page stories about Bitcoin in their largest newspapers.

— Pomp

Things are about to get very, very interesting… https://t.co/gUGNhqQ5XG(@APompliano) November 11, 2019

Advertising Digital Yuan or Genuine Concerns for Bitcoin?

Decrypt reported that Xinhua’s article is criticizing bitcoin so it could lay the groundwork for China’s Digital Currency Electronic Payment (DCEP) program. Matthew Graham, the chief executive of Beijing-based Sino Global Capital who brought the bitcoin article to light, said the Jinping regime is attempting to “shape the narrative surrounding this powerful and strategic technology.”

“They can’t ignore Bitcoin, but they don’t really want to encourage it either,” he said. “They want to slowly push and pull people in the direction of their own vision. What is that vision? State-controlled DCEP in conjunction with blockchain technology throughout the economy.”

Nevertheless, others believe China is opening up to the potential of bitcoin especially against the ongoing macroeconomic meltdown that is leading global central banks to inject fresh fiat supply into the market and increase inflation. Bitcoin as a non-correlated asset proposes to be a hedge against the inflation crisis, as the world has seen in the cases of Venezuela, Argentina, Zimbabwe, and others.

BREAKING

— Biht Coign (@abztrdr) November 8, 2019: Chinese officials have detained a Chinese Bitcoin seller for selling Bitcoin. In the release Xi is quoted "不允许卖,只买".

Chinese citizens are only allowed to BUY Bitcoin. Selling is essentially banned.

Bullish AFhttps://t.co/WfcRrd8TZI

It so appears that China has not banned Bitcoin from its mind. The state is clearly attempting to separate the cryptocurrency from its very-own digital yuan initiative. But with Xinhua terming Bitcoin as the only working app of blockchain, it leaves traders in China with optimism that the President Jinping’s regime would go less-harder on Bitcoin.

The decision to not prohibit Bitcoin mining also points in the same direction. China at best is confused about its prospects towards cryptocurrency, especially when it sets out to challenge the global monopoly of the US dollar by projecting yuan as an alternative.

China is not about to lift the bitcoin trading ban – at least for now. But the state is laying a very bullish foundation for the cryptocurrency.

The post Is China about to Lift the Bitcoin Trading Ban? appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/is-china-about-to-lift-the-bitcoin-trading-ban/?utm_source=rss&utm_medium=rss&utm_campaign=is-china-about-to-lift-the-bitcoin-trading-ban

Thursday, November 7, 2019

5 Factors that Affect Bitcoin Price – Analysis

Since its inception in 2009, Bitcoin has emerged as one of the most popular cryptocurrencies owing to its peer-to-peer payment features. People started exploring it to settle payments cheaply and faster without needing a bank. Meanwhile, a large section of bitcoin users also unearthed immense investment opportunities in it, leading to the birth of the bitcoin retail markets.

People now buy bitcoin to decorate their investment portfolios with non-correlated assets. They hugely speculate that the cryptocurrency would yield high returns in the future. Big financial houses, family offices, and hedge funds are gradually increasing their risk exposures on bitcoin and similar crypto-assets. That is the same reason why bitcoin as a payment medium is suffering. Due to hyper-speculation, bitcoin prices have become more volatile over the years, making it a poor store of value.

In the past years, the market has seen bitcoin and other crypto-assets reach their all-time highs and all-time lows. Bitcoin, being the benchmark, continues to lead the market with its significant market cap. It remains the most dominating cryptocurrency – another reason why it plays an influential role in determining the trend of the entire crypto market. Here’s an example:

Bitcoin was going through an upward flight in late 2017 – as the price almost tested the $20,000 level – the rest of the cryptocurrencies, too, tailed an upward trend to eventually establish their historic highs.

However, when the bitcoin price declined drastically, the rest of the cryptocurrencies followed suit. The unanimous dropdown caused the entire cryptocurrency market to crash by more than 80 percent in 2018. That further explained how Bitcoin exhibited extreme volatility; and that it was also instrumental in determining the bias of the rest of the cryptocurrencies.

It does not mean traders simply should refrain from speculating on bitcoin. Despite its risks, the cryptocurrency also returns impressive profits in a shorter period of time. And owing to its growing demand, allocating a small portion of investment portfolios to non-correlated bitcoin wards off global economic risks.

But while one gets into the bitcoin ecosystem, they should realize the factors that typically drive its prices in either direction. They are:

- Influence of Media

- Effects of Supply and Demand

- Political Events

- Changes in Regulations

- Changes in Bitcoin Community and Rules

1. Influence of Media

Bitcoin is growing into the conscience of global media as its price continues to climb upward. While some reports have been favoring, a large number of outlets remain critical of the cryptocurrency’s investment prospects.

Nevertheless, how the media mentions bitcoin plays an important role in determining its interim market bias. Facebook, for instance, launched a bitcoin-like payment project Libra earlier this year. As the global media, including major outlets like FT.com, WSJ, and the New York Times, covered the story, they also mentioned the likelihood of Facebook putting bitcoin into the conscious of its billions of users.

The media reports fueled bitcoin’s relevance. The price surged by thousands of dollars to establish its year-to-date bias of $14,000. Similarly, when Libra landed in trouble with policymakers all across the world, negative media coverage sent the bitcoin prices down.

Note: Various news aggregators provide daily updates like crypto news, crypto prices, cryptoanalysis, and various other events on their platforms.

As this media coverage will get broadcasted on global platforms, more and more people will get attracted to Bitcoin. If the media coverage is positive, the price of Bitcoin will be higher, and if the media coverage is negative, then we can expect a decline in the price of Bitcoin. These media and social media platforms help in spreading the news (Bitcoin News, Tron News, etc) like wildfire, and this will automatically impact the price.

2. The Supply-Demand Theory

Notably, a majority of bitcoin users prefer to hold it because of its deflationary quality. The cryptocurrency’s supply stands limited to 21 million, while its production typically gets halved after every four years. Therefore, the asset is as scarce as one can be.

On the other hand, speculators believe bitcoin’s demand is set to grow. They see the ongoing macroeconomic and geopolitical crisis as the biggest reasons why big investors would shift to non-correlated, nascent assets like bitcoin. First, they are non-sovereign so any poor government policy will not be able to dent them. And second, they are easily transferrable atop a decentralized protocol, making it better than traditional hedging instruments such as Gold and Bonds.

Any news from the demand-side helps bitcoin. For instance, the US-China trade war this year sent the value of China’s Yuan tumbling. Furthermore, Beijing’s tight control over the outbound fiat capital made it impossible for the Chinese to send big money abroad. Bitcoin solved this problem by acting as a tunnel. The demand increased, and the price followed suit.

Traders need to spot announcements to create a long-term portfolio in bitcoin. Any news that promises to boost bitcoin’s adoption would be bullish for the cryptocurrency, especially against a determined supply cap.

Note: Let’s compare Bitcoin with gold as both of them have a specific amount that is available to be used. For its usage and to make a profit off of it, a miner will have to mine gold to sell it in the marketplace, the same goes for Bitcoin. Bitcoin can be mined using GPU computer systems power, and if successful, miners earn Bitcoins, which hence increases the supply.

With an increase in supply, the price of Bitcoin will go down. This will be again changed as demand will increase, causing the price to rise again.

3. Political Events

Political Events all over the world have a significant impact on everything that is around us, including cryptocurrencies. The traditional currencies get affected too due to the political events, which then affects the price of cryptocurrencies.

Lack of trust in a country’s economy will push people towards using cryptocurrencies as an alternative to the fiat currencies. This will cause an opposite effect on the price of Bitcoin i.e., the price will increase. This effect on Bitcoin will later be seen in the whole crypto market.

Note: Donald Trump, in several tweets, has mentioned how Bitcoin and other cryptocurrencies are just currencies and assets in the air which can’t be used. Various news aggregators have listed this as a severe concern for the future of Bitcoin.

This effect was noticed during Britain’s decision to leave the European Union or when Donald Trump was elected as the president of the U.S. The latest example of this is the trade war between China and the U.S. All these events push people to invest in cryptocurrencies.

4. Changes in Regulations

Bitcoins and other cryptocurrencies have been in the system for a few years now, but they are still an early concept to be accepted by the governments. The regulations and rules regarding them are continually changing in terms of taxation and anti-money laundering norms.

Bitcoin is decentralized and away from the influence of governments or any central bank, and any changes in the regulations will affect the working of cryptocurrencies. Any government statement or decision against cryptocurrencies will cause a downfall in Bitcoin’s price.

In 2017, China decided to shut down several exchange platforms that caused the price to fall dramatically. Another drop in the crypto market was $100 billion when various Asian governments decided to make some regulatory changes.

Note: India imposed a blanket ban on cryptocurrencies last year, fearing the instruments could be used for money laundering, terrorist funding, and various other illegal tasks. There has been a legal battle going on since then between the crypto community and the RBI and government.

5. Changes in the Bitcoin community and rules

One of the reasons behind the Bitcoin’s volatility is the confusion that the community faces when it comes to ensuring the future Bitcoin in the middle and long term.

Any decision made by the Bitcoin community affects its blockchain and the entire ecosystem of the crypto market. When the common grounds are not met for decision making, this leads to the hard fork of Bitcoin separating it into two blocks. This hard fork caused the launch of Bitcoin Cash in 2017.

Note: Many traders known as Bitcoin whales play an essential role in the community as they have “bags” full of Bitcoin, which they can dump anytime to alter the crypto market.

These disputes in the community because of the rules of Bitcoin and its future in the world often causes the price to decline. However, with the introduction of the hard fork, the price went upwards, making it an investment opportunity for traders.

Conclusion

Like every financial market, Bitcoin and cryptocurrencies face varying trends in the charts, and because of the involvement of blockchain, the increase and decrease in the prices are much stronger. These are the top factors that were observed over a long time and have been responsible for the fluctuations in the prices.

By: Heena Vinayak

Author Bio: Heena Vinayak is the Founder of KillerLaunch.com, a company that helps startups & companies find catchy, killer domain names.

The post 5 Factors that Affect Bitcoin Price – Analysis appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/5-factors-that-affect-bitcoin-price-analysis/?utm_source=rss&utm_medium=rss&utm_campaign=5-factors-that-affect-bitcoin-price-analysis

Tuesday, November 5, 2019

The Big Fat Stellar Pump; What’s Causing It?

Stellar is leading the gains in the cryptocurrency market on Tuesday as the blockchain project swells by 18 percent in market valuation.

A back-to-back buying session has brought XLM, Stellar’s native token, up by more than 30 percent since yesterday. The XLM-to-dollar exchange rate is now sitting at $0.081, according to data gathered by CoinStats’ cryptocurrency portfolio management app. At its week’s lowest, the pair was trading at $0.062.

The sudden uprise came after the Stellar Development Foundation (SDF), the group which oversees the development of the Stellar blockchain, announced that it would remove 55 billion XLM tokens from supply. Earlier, XLM’s total supply was capped to 105 billion. It means SDF burned half the XLM that would be ever available.

SDF CEO Denelle Dixon explained that they were holding onto more lumens than they needed. In an address given to about 200 attendees of Stellar’s annual conference, Mr. Dixon said that their organization realized how much XLM would they need to sustain their growth over the next decade. Eventually, the team decided to wipe-off 5 billion XLM from its operational fund and another 50 billion from their airdrop allocation.

“We’ve decided to reduce our lumen allocations and to rededicate what remains to what we now think Stellar needs most. We’ll use approximate numbers here in the text, but the chart and table to follow detail the precise amounts in question,”

said Mr. Dixon in his announcement.

Scarcity is Bullish

People started offloading their cryptocurrency capital on Stellar, believing that reduced supply would make it more bullish against a potentially rising demand.

Nevertheless, XLM on larger timeframes looked extremely bearish against its rival asset Bitcoin. In 2019, the XLM-to-BTC exchange rate slipped by as much as 80 percent. So, the recent revival in the XLM market did not necessarily promise an extended upside correction for the token.

The post The Big Fat Stellar Pump; What’s Causing It? appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/the-big-fat-stellar-pump-whats-causing-it/?utm_source=rss&utm_medium=rss&utm_campaign=the-big-fat-stellar-pump-whats-causing-it