Since its inception in 2009, Bitcoin has emerged as one of the most popular cryptocurrencies owing to its peer-to-peer payment features. People started exploring it to settle payments cheaply and faster without needing a bank. Meanwhile, a large section of bitcoin users also unearthed immense investment opportunities in it, leading to the birth of the bitcoin retail markets.

People now buy bitcoin to decorate their investment portfolios with non-correlated assets. They hugely speculate that the cryptocurrency would yield high returns in the future. Big financial houses, family offices, and hedge funds are gradually increasing their risk exposures on bitcoin and similar crypto-assets. That is the same reason why bitcoin as a payment medium is suffering. Due to hyper-speculation, bitcoin prices have become more volatile over the years, making it a poor store of value.

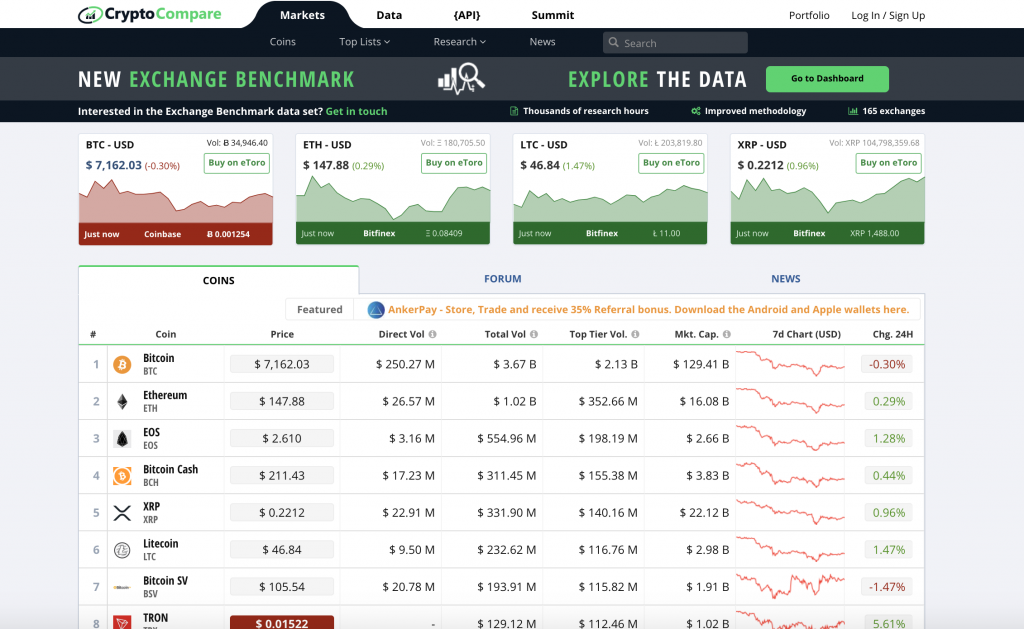

In the past years, the market has seen bitcoin and other crypto-assets reach their all-time highs and all-time lows. Bitcoin, being the benchmark, continues to lead the market with its significant market cap. It remains the most dominating cryptocurrency – another reason why it plays an influential role in determining the trend of the entire crypto market. Here’s an example:

Bitcoin was going through an upward flight in late 2017 – as the price almost tested the $20,000 level – the rest of the cryptocurrencies, too, tailed an upward trend to eventually establish their historic highs.

However, when the bitcoin price declined drastically, the rest of the cryptocurrencies followed suit. The unanimous dropdown caused the entire cryptocurrency market to crash by more than 80 percent in 2018. That further explained how Bitcoin exhibited extreme volatility; and that it was also instrumental in determining the bias of the rest of the cryptocurrencies.

It does not mean traders simply should refrain from speculating on bitcoin. Despite its risks, the cryptocurrency also returns impressive profits in a shorter period of time. And owing to its growing demand, allocating a small portion of investment portfolios to non-correlated bitcoin wards off global economic risks.

But while one gets into the bitcoin ecosystem, they should realize the factors that typically drive its prices in either direction. They are:

- Influence of Media

- Effects of Supply and Demand

- Political Events

- Changes in Regulations

- Changes in Bitcoin Community and Rules

1. Influence of Media

Bitcoin is growing into the conscience of global media as its price continues to climb upward. While some reports have been favoring, a large number of outlets remain critical of the cryptocurrency’s investment prospects.

Nevertheless, how the media mentions bitcoin plays an important role in determining its interim market bias. Facebook, for instance, launched a bitcoin-like payment project Libra earlier this year. As the global media, including major outlets like FT.com, WSJ, and the New York Times, covered the story, they also mentioned the likelihood of Facebook putting bitcoin into the conscious of its billions of users.

The media reports fueled bitcoin’s relevance. The price surged by thousands of dollars to establish its year-to-date bias of $14,000. Similarly, when Libra landed in trouble with policymakers all across the world, negative media coverage sent the bitcoin prices down.

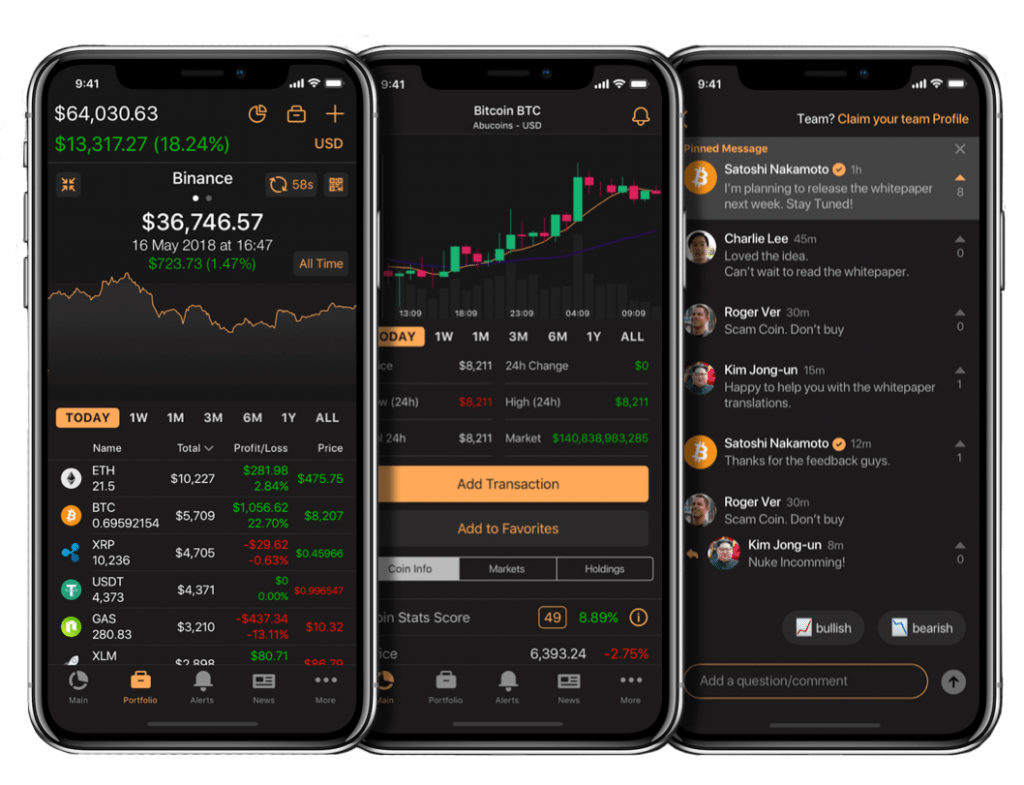

Note: Various news aggregators provide daily updates like crypto news, crypto prices, cryptoanalysis, and various other events on their platforms.

As this media coverage will get broadcasted on global platforms, more and more people will get attracted to Bitcoin. If the media coverage is positive, the price of Bitcoin will be higher, and if the media coverage is negative, then we can expect a decline in the price of Bitcoin. These media and social media platforms help in spreading the news (Bitcoin News, Tron News, etc) like wildfire, and this will automatically impact the price.

2. The Supply-Demand Theory

Notably, a majority of bitcoin users prefer to hold it because of its deflationary quality. The cryptocurrency’s supply stands limited to 21 million, while its production typically gets halved after every four years. Therefore, the asset is as scarce as one can be.

On the other hand, speculators believe bitcoin’s demand is set to grow. They see the ongoing macroeconomic and geopolitical crisis as the biggest reasons why big investors would shift to non-correlated, nascent assets like bitcoin. First, they are non-sovereign so any poor government policy will not be able to dent them. And second, they are easily transferrable atop a decentralized protocol, making it better than traditional hedging instruments such as Gold and Bonds.

Any news from the demand-side helps bitcoin. For instance, the US-China trade war this year sent the value of China’s Yuan tumbling. Furthermore, Beijing’s tight control over the outbound fiat capital made it impossible for the Chinese to send big money abroad. Bitcoin solved this problem by acting as a tunnel. The demand increased, and the price followed suit.

Traders need to spot announcements to create a long-term portfolio in bitcoin. Any news that promises to boost bitcoin’s adoption would be bullish for the cryptocurrency, especially against a determined supply cap.

Note: Let’s compare Bitcoin with gold as both of them have a specific amount that is available to be used. For its usage and to make a profit off of it, a miner will have to mine gold to sell it in the marketplace, the same goes for Bitcoin. Bitcoin can be mined using GPU computer systems power, and if successful, miners earn Bitcoins, which hence increases the supply.

With an increase in supply, the price of Bitcoin will go down. This will be again changed as demand will increase, causing the price to rise again.

3. Political Events

Political Events all over the world have a significant impact on everything that is around us, including cryptocurrencies. The traditional currencies get affected too due to the political events, which then affects the price of cryptocurrencies.

Lack of trust in a country’s economy will push people towards using cryptocurrencies as an alternative to the fiat currencies. This will cause an opposite effect on the price of Bitcoin i.e., the price will increase. This effect on Bitcoin will later be seen in the whole crypto market.

Note: Donald Trump, in several tweets, has mentioned how Bitcoin and other cryptocurrencies are just currencies and assets in the air which can’t be used. Various news aggregators have listed this as a severe concern for the future of Bitcoin.

This effect was noticed during Britain’s decision to leave the European Union or when Donald Trump was elected as the president of the U.S. The latest example of this is the trade war between China and the U.S. All these events push people to invest in cryptocurrencies.

4. Changes in Regulations

Bitcoins and other cryptocurrencies have been in the system for a few years now, but they are still an early concept to be accepted by the governments. The regulations and rules regarding them are continually changing in terms of taxation and anti-money laundering norms.

Bitcoin is decentralized and away from the influence of governments or any central bank, and any changes in the regulations will affect the working of cryptocurrencies. Any government statement or decision against cryptocurrencies will cause a downfall in Bitcoin’s price.

In 2017, China decided to shut down several exchange platforms that caused the price to fall dramatically. Another drop in the crypto market was $100 billion when various Asian governments decided to make some regulatory changes.

Note: India imposed a blanket ban on cryptocurrencies last year, fearing the instruments could be used for money laundering, terrorist funding, and various other illegal tasks. There has been a legal battle going on since then between the crypto community and the RBI and government.

5. Changes in the Bitcoin community and rules

One of the reasons behind the Bitcoin’s volatility is the confusion that the community faces when it comes to ensuring the future Bitcoin in the middle and long term.

Any decision made by the Bitcoin community affects its blockchain and the entire ecosystem of the crypto market. When the common grounds are not met for decision making, this leads to the hard fork of Bitcoin separating it into two blocks. This hard fork caused the launch of Bitcoin Cash in 2017.

Note: Many traders known as Bitcoin whales play an essential role in the community as they have “bags” full of Bitcoin, which they can dump anytime to alter the crypto market.

These disputes in the community because of the rules of Bitcoin and its future in the world often causes the price to decline. However, with the introduction of the hard fork, the price went upwards, making it an investment opportunity for traders.

Conclusion

Like every financial market, Bitcoin and cryptocurrencies face varying trends in the charts, and because of the involvement of blockchain, the increase and decrease in the prices are much stronger. These are the top factors that were observed over a long time and have been responsible for the fluctuations in the prices.

By: Heena Vinayak

Author Bio: Heena Vinayak is the Founder of KillerLaunch.com, a company that helps startups & companies find catchy, killer domain names.

The post 5 Factors that Affect Bitcoin Price – Analysis appeared first on CoinStats Blog.

from

CoinStats Blog https://blog.coinstats.app/5-factors-that-affect-bitcoin-price-analysis/?utm_source=rss&utm_medium=rss&utm_campaign=5-factors-that-affect-bitcoin-price-analysis

(@APompliano)

(@APompliano)  : Chinese officials have detained a Chinese Bitcoin seller for selling Bitcoin. In the release Xi is quoted "不允许卖,只买".

: Chinese officials have detained a Chinese Bitcoin seller for selling Bitcoin. In the release Xi is quoted "不允许卖,只买".