In this article, CoinStats delves into the world of two exchanges to know which one is better in the always-heated Binance vs Coinbase competition.

The first step for any average Joe who has just decided to venture into the world of cryptocurrency trading is to find that one crypto exchange that brings a decent debut experience. Unfortunately, not many offer that.

There are now a total of 504 big and small firms that offer people to buy, sell, and store cryptocurrencies. But more than 90 percent of them are found to be engaged in shady practices. In some cases, users find themselves unable to withdraw their funds. In a dozen other examples, the exchange puts users’ money at risk by ensuring poor security practices.

Hacks, frauds, vaporware, wash trading, poor liquidity, fake volumes, exuberant trading fees, etc. have become a part of most of those 504 exchanges. But thankfully, not all of them are culprits.

Binance and Coinbase are two names that rule the crypto exchange sector. Yes, they have had their share of setbacks in the past, but that did not deter them from building a reliable trading ecosystem for new and professional traders alike.

Choosing which one among them is better than the other is like comparing Matrix with Inception. Both exchanges lag and lead each other on certain levels. But on a whole, they deliver almost the same good experience to traders.

In this review, we attempt to judge Binance and Coinbase from the newbies’ point of view. Some of us may want to face fewer regulatory hurdles while trading cryptocurrencies. While others among us may need Uncle Sam’s shadow to protect ourselves from any potential mishappening.

The perceptions are different. And that is how one can choose which exchange – Coinbase or Binance – is better for him/her. Let’s start with some crucial H2s.

Regulation

The world of cryptocurrency exchanges appears divided based on two parameters: US and non-US.

It would be safe to say that the US has one of the strictest law enforcement bodies when it comes to handling bitcoin-enabled firms. One cannot offer Americans crypto trading services without obtaining a regulatory license. And those who try either end up getting fined/sued or outright shut down.

Coinbase works under the US regulatory climate since inception. On the other hand, Binance has just entered the country through a regional vertical of the same name. Otherwise, the exchange is based out of safe-haven Malta, from where it caters to users all across the world.

The regulation differs likewise. Coinbase will offer its services in only those nations which have granted it a license. Meanwhile, it will list only those tokens that fit the description of tradable assets under the local laws.

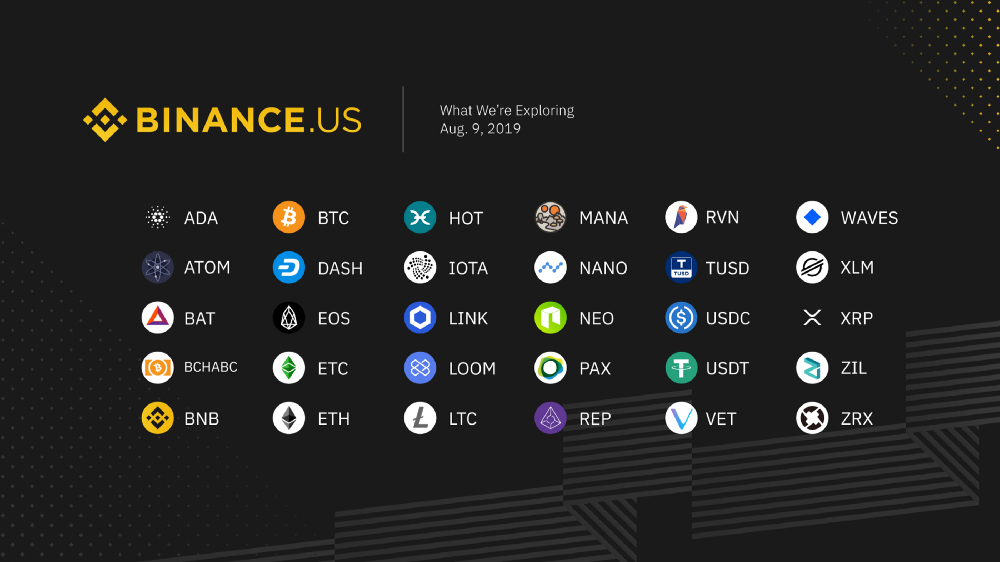

On the other hand, Binance lists more crypto tokens – a better selection of trading. It offers services in almost every corner of the world – if local laws are stiff, then users cannot trade cryptos with fiat; otherwise, they can.

Conclusion: Binance is ideal for traders who are looking for more regulatory flexibility. Meanwhile, Coinbase serves as a better alternative for traders based out of countries with stricter crypto regulations. It is always advised to check-in with their local legal status before signing up.

Services

Both Coinbase and Binance – as stated above – offers a wide range of cryptocurrencies to trade. Like any other exchange, they both have an interactive trading platform that lets you work practically from the same page.

Coinsbase Pro, the exchange’s advanced trading version, boasts of real-time order books, trade histories, and charting tools. Binance offers almost the same thing. But where they both differ from each other is services.

Binance, for instance, offers a range of additional trading features on its platform, which include high leveraged (but risky) futures trading. Meanwhile, holding the platform’s native asset BNB could have traders accessed a bunch of other services, which include early investment opportunities Initial Exchange Offerings (IEOs), the Lottery System, and Staking.

Coinbase also offers staking services. But its more highlighting features cater to institutional investors. The exchange offers custodial solutions to hedge funds, family offices, and other big financial institutions.

Coming to Coinbase vs Binance in terms of trading fees, the former is more expensive. While Coinbase Fees is anywhere between 1.49 percent and 3.49 percent depending on the trade, Binance Fees is a mere 0.1 percent.

It also offers Bundle, a service that allows traders to buy five cryptocurrencies at once (75.2% BTC, 15.58% ETH, 2.33% LTC, 6.11% BCH, and 0.78% ETC).

Coinbase also features an OTC desk for offline traders.

Conclusion: There is no Binance vs Coinbase here. The latter is always a better platform for institutional traders looking for a regulatory safety net while injecting large capitals into the crypto market. Binance, on the other hand, is more focused on meeting the demands of retail clients.

Liquidity and Volume

A report published by the Blockchain Transparency Institute in 2019 put Binance and Coinbase for having adequate liquidity and real trade volume. Even Bitwise’s popular Real 10 noted that there is no Coinbase vs Binance in real trade volumes. Both are genuine.

Coinbase Pro regularly handles $100-200 million of volume per day, mettle for a nascent industry. Binance US, on the other hand, process trades worth $5-10 million per day.

And then, there is liquidity. Crypto Watch reports that Binance US has $4 million of liquidity. Meanwhile, Coinbase Pro boasts of $15 million on the same scale. In reality, the liquidity of Binance should be higher given its partnerships with local exchanges all across the world. But the latest data is not available to measure that.

The liquidity limitations are reflected in the trading limits. Binance with its lower liquidity has imposed limits on trades. Traders, for instance, cannot place BTC/USD orders larger than $20 million. That is actually sufficient but a limit is, after all, a limit.

Coinbase offers unlimited trading.

On the other hand, Binance is better when it comes to withdrawing your money. The exchange allows investors to take out $1 million via wire and deposit up to $30,000 via ACH bank transfers. Coinbase has a daily withdrawal limit of $10,000 against unlimited deposits.

Conclusion: The winner of Binance vs Coinbase competition in terms of liquidity and volume is clearly the latter. Nevertheless, both the exchanges have seldom run into delayed market orders or poor depth.

Security

As a crypto user, when you sign up with Coinbase or Binance, you put your funds into their custody. If they lose them, you lose them. But none of the exchanges have actually caused losses to their users.

Binance got hacked for $40 million last year, but it compensated all the affected users. Coinbase, on the other hand, accidentally leaked users’ data but never fell victim to a fund-related hack.

Conclusion: Keep playing Binance vs Coinbase! But in reality, exchanges are not 100 percent secure. So it is better to keep a limited capital with them all the time.

The post Binance vs Coinbase: Which Crypto Exchange Is Better? appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/binance-vs-coinbase-which-crypto-exchange-is-better/?utm_source=rss&utm_medium=rss&utm_campaign=binance-vs-coinbase-which-crypto-exchange-is-better