Steven Mnuchin was one of the biggest catalysts behind the Bitcoin rebound last week.

The US Treasury Secretary, known for having an ill-opinion about the cryptocurrency, sat alongside his knee-shaking buddy, the Federal Reserve Chairman Jerome Powell, before the Senate Banking Committee on Thursday. He testified about the coronavirus’s impact on the US economy and how his office is planning to handle the situation by vouching for more stimulus.

That Long-Delayed Aid

Stimulus, as all of our readers know already, is an aid–a financial help–offered by the government or the central bank to people who need it the most. The coronavirus pandemic has pushed many small and medium scale firms out of business. As a result, the joblessness in the US is now lurking at record levels. People have rents to pay, but they don’t have access to money.

The US government in late March had stepped in with a $2 trillion relief. The package helped American adults with $1,200 checks. It further gave families an additional $500 per child under 17.

But the aid is running out of steam. The unemployment rate is near-steady, which means that the US economy is not adding or recovering any jobs. On the other hand, the coronavirus pandemic is threatening to rise again as the winter season kicks in. It would mean more lockdowns, more business failures, and more unemployed Americans.

Mr. Mnuchin realizes that one hundred percent. The White House official committed to resuming negotiations with the US Congress to release the second coronavirus stimulus on Thursday.

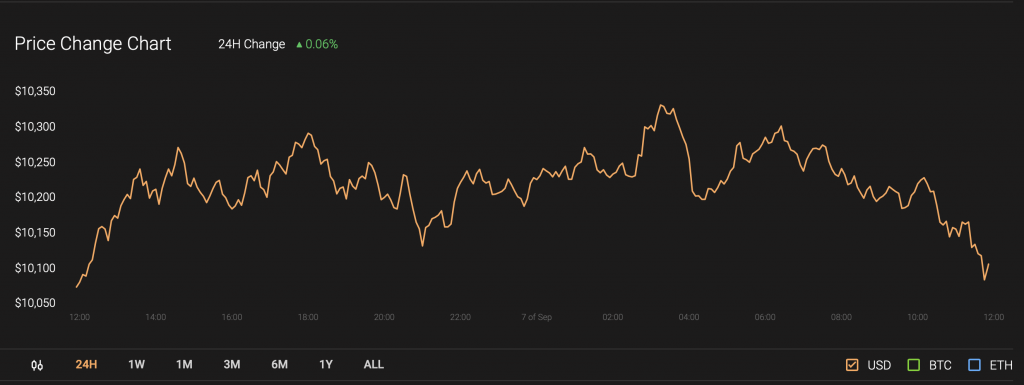

His statement injected the Bitcoin market with enthusiasm. The cryptocurrency rose more than 4 percent on that day, breaking away from losing momentum at the beginning of the same week. BTC/USD kept rising through the weekend thanks to another accidental bull called Nancy Pelosi.

The House Speaker told CNN that she is hoping for a deal as the Democrats and Republicans sit for a one-to-one on Friday. She said:

“I’d rather have a deal to put money in people’s pockets than to have a rhetorical argument.”

Democrats have reportedly prepared a new proposal that demands $2.4 trillion in aid for Americans. The new bill would return improved unemployment benefits, direct payments to qualified Americans, the Paycheck Protection Program for small-business loan funding, and airline aid. It could be ready for a vote by Oct. 2.

Pelosi’s statements came on Sunday. Bitcoin added another 3.41 percent following the event.

The Bitcoin Outlook Now

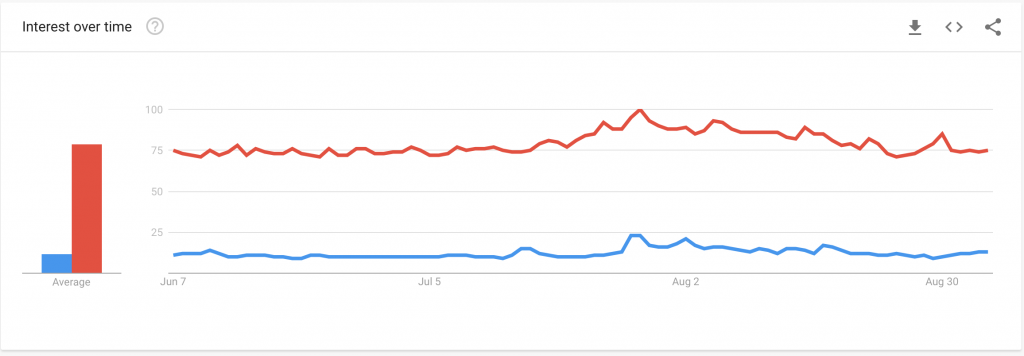

Bitcoin bulls love anything that is or rhymes with the word ‘stimulus.’ Their narrative is pretty simple: House passes the aid, more dollars enter the US economy, the US dollar index falls, investors run for cover in riskier assets, and Bitcoin rises.

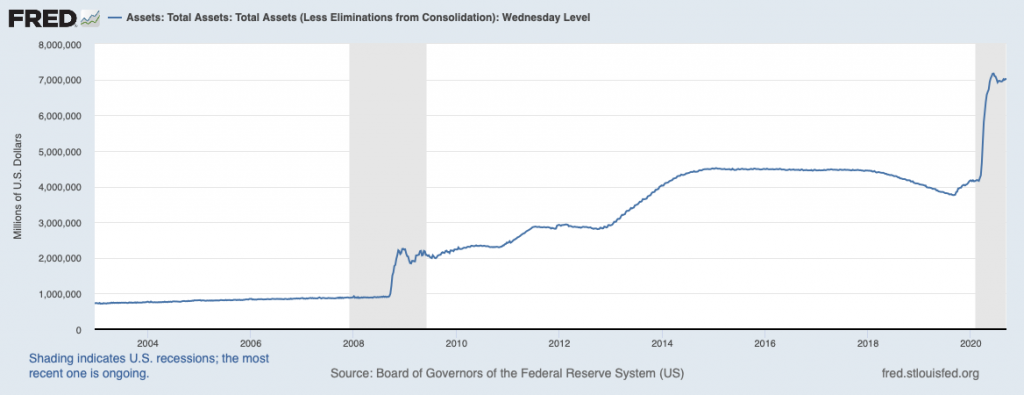

It has happened before in March. Bitcoin was able to come out of a deadly bear-led crash only after the Federal Reserve announced an infinite bond-buying program and slashed its interest rates to near zero.

Read more: Bitcoin, Wall Street, And The End Of Their Social Distancing

The US Congress further fueled the Bitcoin price rally after announcing a $2 trillion stimulus package. That all happened as the US dollar lost its value and fell to a 27-month low just at the start of this September.

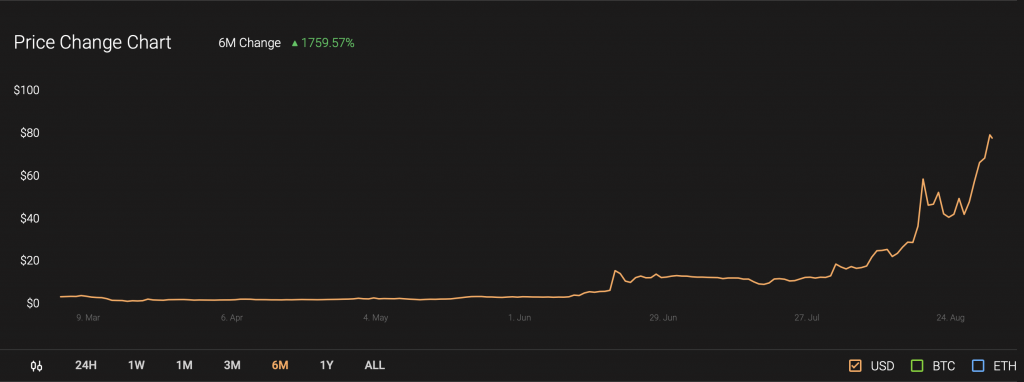

Bitcoin, at the same time, surged by more than 200 percent.

Just recently, the Fed committed to keeping interest rates near zero until 2023. The US central bank also said that it would raise inflation above its 2 percent target. That further made investors bullish about Bitcoin for the long-term.

The only missing key, in the currentt scenario, was a stimulus package. Americans have already absorbed the last aid. They want more. And the US government has to give its citizens what they want especially if they don’t want to see their anger in the next presidential election in November.

Read further: No $20,000 Bitcoin Until Us Presidential Election 2020

With Mnuchin and Pelosi committing to restart negotiations, people can expect Bitcoin to stay steady or bullish for this week. The cryptocurrency might close above $11,000 after all. But its next price action course entirely depends on whether or not the US Congress passes the stimulus bill.

If they don’t, expect Bitcoin to fall back towards $10,000.

Since you’re here, feel free to check out the CoinStats cryptocurrency portfolio management app to track and manage your Bitcoin and altcoin investments.

The post Hopes for Bitcoin Rally as Americans Prepare for Second Coronavirus Stimulus appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/hopes-for-bitcoin-rally-as-americans-prepare-for-second-coronavirus-stimulus/?utm_source=rss&utm_medium=rss&utm_campaign=hopes-for-bitcoin-rally-as-americans-prepare-for-second-coronavirus-stimulus

is signaling a short term bearish reversal continuing the Macro bearish reversal

is signaling a short term bearish reversal continuing the Macro bearish reversal now breaking out into new local highs

now breaking out into new local highs