It has been more than a week since the high-profile launch, but Bakkt’s trading volume remains underwhelming with only 16 BTC as of this time of writing. Meanwhile, the spot rate of bitcoin has plunged massively, rising fears that Bakkt hype has not done well to the crypturrency.

Bakkt An Underperforming Horse?

Against all the expectations, the launch of the first CFTC-approved, physically-settled bitcoin futures contracts did not find enough takers on Wall Street. The first-day volume in the monthly contract was only 71 BTC. And, at last week’s close, Bakkt merely processed transactions worth $5 million, with its daily future trading just five contracts.

By comparison, rival Chicago-based exchange operators CME traded more than 4,000 bitcoin futures contracts on Friday alone. Launched in December 2017, CME was riding high on its experience as a bitcoin derivatives offerer. Unlike Bakkt, the operator traded around $70 million worth of “cash-settled” bitcoin futures in the first 12 hours of its launch. It is not a fair comparison, anyway, because craze for bitcoin was at its peak in December 2017. Those factors are missing around the launch of Bakkt.

The Big Fat Bitcoin Drop

Bakkt’s launch came at the least perfect time. CoinStats’ data shows that the bitcoin price slipped by more than $2,300 after the Intercontinental Exchange (ICE) listed Bakkt’s bitcoin futures on its platform. That was a complete opposite of what traders, speculators, and investors had expected.

A general consensus treated Bakkt as a catalyst to drive bitcoin prices up. The explanation was straightforward: for most of the market participants, Bakkt was bullish for bitcoin because it safely brought the cryptocurrency before institutional investors. The firm’s product boasted of settling contracts in bitcoin-only, meaning investors could actually hold the cryptocurrency at some point of the time.

Unfortunately, that did not happen. With institutions showing minimal interest in the newly-launched bitcoin futures, the bitcoin price continued its downtrend, dropping to as far as $7,700 on September 30.

Analysts at JPMorgan Chase & Co. stated that Bakkt drove bitcoin prices lower after posting lower-than-expected volumes. They said in a report dated Friday:

“It may be that the listing of physically settled futures contracts (that enables some holders of physical Bitcoin e.g. miners to hedge exposures) has contributed to recent price declines, rather than the low initial volumes.”

Lets Not Blame Bakkt Only

Other factors also contributed in the falling of bitcoin. There were concerns related to the SEC’s disapproval of bitcoin-enabled exchange-traded funds while the cryptocurrency’s extended downside correction from its yearly top of $14,000 further indicated the likelihood that it was merely neutralizing its overbought conditions.

JP Morgan analyst Nikolaos Panigirtzoglou noted that institutional investors started ditching bitcoin derivatives shortly after the Facebook’s Libra craze fizzled. He and team explained that long exposures in CME contracts were on a decline. At the same time, the BitMEX position proxy suggested market capitulation at retail level, driven by unknown factors.

“This position liquidation has also likely contributed to the sharp falls in Bitcoin prices this week,” the strategists said. “While the previous overhang of long Bitcoin futures positions appears to have cleared in Bitmex futures, this is not yet true for CME contracts.”

That said, bitcoin could be looking at a further downside correction in the future.

Would Investors Come to Bitcoin?

Bitcoin prices are going down against a gloomy macroeconomic outlook. If considered from the point of view of an institutional investors – a hedge fund manager, for instance – he/she could either put funds in a risky asset or safe-haven alternatives. Bitcoin has not faced a single economic crisis in the history of its existence, which might influence any investor to limit his/her portfolio’s exposure to the cryptocurrency.

Meanwhile, speculators are already driving the bitcoin prices lower in a largely unregulated spot market. To say the price would find a floor and big investors would want to buy bitcoin cheap is an overstatement. Any investor would first want to protect his/her portfolio against the ongoing US-China trade war, rising geopolitical conflicts in the Middle East, and fears of a recession.

It does not necessarily mean that bitcoin would remain a silent bystander. What Bakkt and others are doing by introducing physically-settled bitcoin derivatives is – at least – opening a gateway to a new breed of financial instruments.

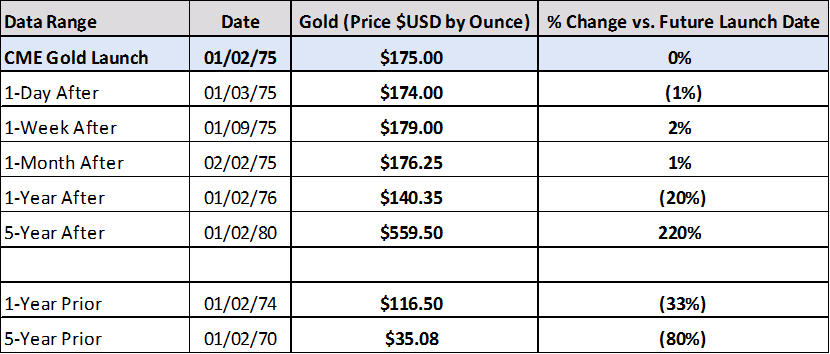

For instance, the launch of Gold Futures by the CME in 1975 did not impact the yellow metal’s spot rate overnight. For the first six months, the XAU/USD rate seldom moved. After a year passed, the pair experienced a 20 percent downside move.

After five years, however, Gold spot price rose by 220 percent – from $179 to $559.20, driven by demand from financial institutions. That coincided with the Soviet-Afghan war, prior to which the Middle East started purchasing large stockpiles of gold.

Conclusion

Gold does not behave as a benchmark for Bitcoin. But since the assets’ share a similar core foundation – that of scarcity and store-of-value – one could expect the latter to react to Bakkt news not today, but anytime later. Galen Moore of CoinDesk writes:

“It remains to be seen whether physical delivery will be a feature that compels market participation. It’s not always very important in derivatives built on other asset categories. One thing appears certain: no new financial instrument is likely to “unlock” institutional demand, as most institutions are only beginning to answer the question of why they would invest in bitcoin in the first place.”

It is for the very same reason Bakkt did not push bitcoin prices up. It is not supposed to. Investors need to see value in bitcoin to make a call. And unless the cryptocurrency does not come up with a clear preposition, the likelihood of Bakkt volume – or any bitcoin-focused derivative volume – is low.

Since you’re here… Please follow us on Twitter or Facebook to receive the timely crypto price and news updates. Also, download CoinStats’ cryptocurrency portfolio management app to stay updated with the minute-to-minute crypto price movements, manage your personal cryptocurrency portfolio, and check on the market sentiment with our interactive social trading tools.

The post Study: Why Bakkt Didn’t Push Bitcoin Prices Up? appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/study-why-bakkt-didnt-push-bitcoin-prices-up/?utm_source=rss&utm_medium=rss&utm_campaign=study-why-bakkt-didnt-push-bitcoin-prices-up

No comments:

Post a Comment