“Negative interest rates? Over my dead body.”

Jerome Powell did not say that. But if one were to reimagine the Federal Reserve chairman in a superhero comic book, that is precisely how his dramatized version would have screamed about “the biggest monetary policy experiment of modern times.”

In the real world, a less-theatrical Powell conveyed the same message during a webinar last week. The finance veteran rejected negative interest rates for its prospects to aid an injured U.S. economy. Instead, he asserted that the Fed has sufficient tool kits, which include open-ended asset purchases and various lending programs, to shied the U.S. market.

But what makes negative rate cuts suddenly the hot topic on Wall Street? Let’s first get to its basics.

Negative Rate Cuts Explained

The best way to understand negative rate cuts is a savings account. When interest rates are positive, the banker pays the account holder an annual return for keeping his money in the commercial bank. Meanwhile, when rates plunge below zero, an account holder has to pay the bank for keeping his money.

Now in a macro setting, the account holder turns into a commercial bank that stores its money at the central bank. So this time, under a negative rate setting, the commercial bank pays the central bank.

The idea behind the so-called experiment is to encourage banks to loan more money instead of keeping it with the central bank. It ideally lowers the financial costs for businesses and households, and thus, stimulate the economy.

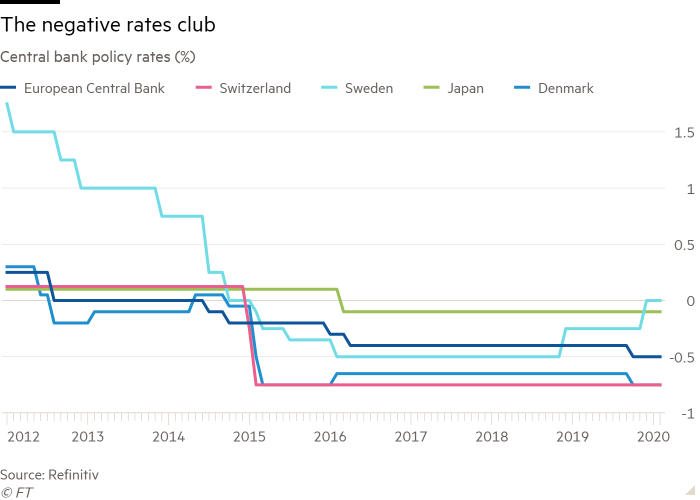

Denmark, Japan, Switzerland, and the eurozone have negative rates. The European Central Bank, which pushed the cost of lending down to minus 0.5 percent last year, noted that keeping rates over zero would have meant a 3 percent smaller economy with 2 million more unemployed

But negative interest remains a large scale experiment without any historical data. Christine Lagarde, president of the ECB, earlier in February 2020 admitted that she wouldn’t draw any long-term conclusion from their policy.

An Unplanned Federal Rate Cut

Powell and his teammates at the Federal Open Market Committee are not big fans of negative interest rates policies. Even the Fed’s decision to raise interest rates invited “bonehead” criticism from the orange man himself – that president called Donald Trump.

But the arrival of Covid19 changed everything for the U.S central bank. The infection spreads quickly from human-to-human or from the things that came into the infected individuals. Its fast-spreading caused nasal and respiratory disease in nearly 1.54 million Americans, killing about 90,000 of them.

The nature of the virus is such that it forced people into their homes and brought the U.S. economy at a standstill. Over 36 million Americans lost their jobs, businesses filed for bankruptcy, and, in Powell’s own words, risked the U.S. growth to fall by 30 percent.

As a result, the Fed’s interest rate decision was to cut it to almost zero to boost lending. That prompted the U.S. interest rate futures market foreseeing further interest rate cuts by the Fed – all below zero. The prediction appeared because the market believes that Powell could fall under the pressure of Trump.

But Powell denied Fed’s prospects venturing into a ‘below zero’ policy. He instead stressed that the U.S. Congress should introduce a new fiscal measure to help the suffering of American households and businesses. That was the superhero’s comic book moment to pressure the orange man.

“Additional fiscal support could be costly, but worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery,” Powell said. “This trade-off is one for our elected representatives, who wield powers of taxation and spending.”

The message was loud and clear: “Negative interest rates? Over my dead body.”

Investors’ Outlook

Despite Powell’s assurances, one cannot deny that nobody can predict when the coronavirus pandemic would come to halt. Powell expects the government to raise funds via the sale of sovereign bonds, even though near-zero rates offer investors meager returns on their short and long-term investments.

Moreover, the Fed never really denied the prospects of negative rates. The FOMC meeting minutes from October shows that the central bank could “reassess the potential role of negative interest rates as a policy tool” under special circumstances.

Atop that, the Fed, and its equivalents around the globe are already running a quantitative easing/asset purchase program to help everyone from citizens to corporates, leading to the biggest debt bubble in history.

The sum of all the factors leads investors fear a higher inflation rate due to constant money printing.

An analyst even said that the U.S. markets could face hyperinflation due to the Fed’s open-ended stimulus policies. So far, Venezuela is the best case study on inflation economics.

Should that happen, investors could end up moving away from bonds and cash-based assets. They would consider putting their money in highly risky/safe-haven/hedging assets, such as equities, gold, and bitcoin-like cryptocurrency (or crypto).

Coincidentally, all three have risen in tandem after the launch of Fed’s $6 trillion stimulus program.

Meanwhile, a negative interest rate in the U.S. could spell trouble for any economy with existing below-zero rates. Many experts believe that Europe was able to sustain the policy because it drove investors to the safety of the U.S. bonds market that was offering better yields.

That said, institutional investors will be left with no opportunities for their clients should the Fed approach a negative rate policy. The worsening coronavirus pandemic serves as a trigger that could change Powell’s mind.

Why Crypto?

Search for better yields would greatly profit assets that have lasted a set of the financial crisis and emerged out even stronger. That includes Gold. Even Bitcoin, an emerging crypto asset, could offer a Gold-like hedge against the potential Federal Reserve’s negative rate crisis.

Part of the reason is the crypto’s part-money, part-commodity features. Also, those looking to evade the inflation caused by open-ended money printing could find hedging into bitcoin attractive for its hard supply cap of 21 million units.

Looking for a separate report on the best bitcoin hedge funds? Tell us in the comment box below.

The post Negative Interest Rates & Its Potential Impact on Crypto Market appeared first on CoinStats Blog.

from CoinStats Blog https://blog.coinstats.app/negative-interest-rates-and-its-potential-impact-on-crypto-market/?utm_source=rss&utm_medium=rss&utm_campaign=negative-interest-rates-and-its-potential-impact-on-crypto-market

No comments:

Post a Comment